Sign In

How Amazon plans to stay relevant in fashion against Flipkart, Reliance

Aditi Shrivastava

Aditi Shrivastava

When Amazon didn’t move fast enough to acquire fashion portal Jabong or Myntra, it wrote off any chance of winning in the domestic apparel sector. But the category is too big to be dismissed and Amazon’s again approaching it with a fresh lens. In some instances, its playbook mirrors Flipkart’s

September 15, 2021

7 MINS READSearching for a white t-shirt, black kurta or innerwear? Amazon is the place for you. But if you want the trendiest outfits straight off Instagram, you are better off browsing elsewhere.

Fashion is one category that’s thrown Amazon off balance. Despite being one of the largest contributors to ecommerce volumes, Amazon has struggled to build an online fashion business globally.

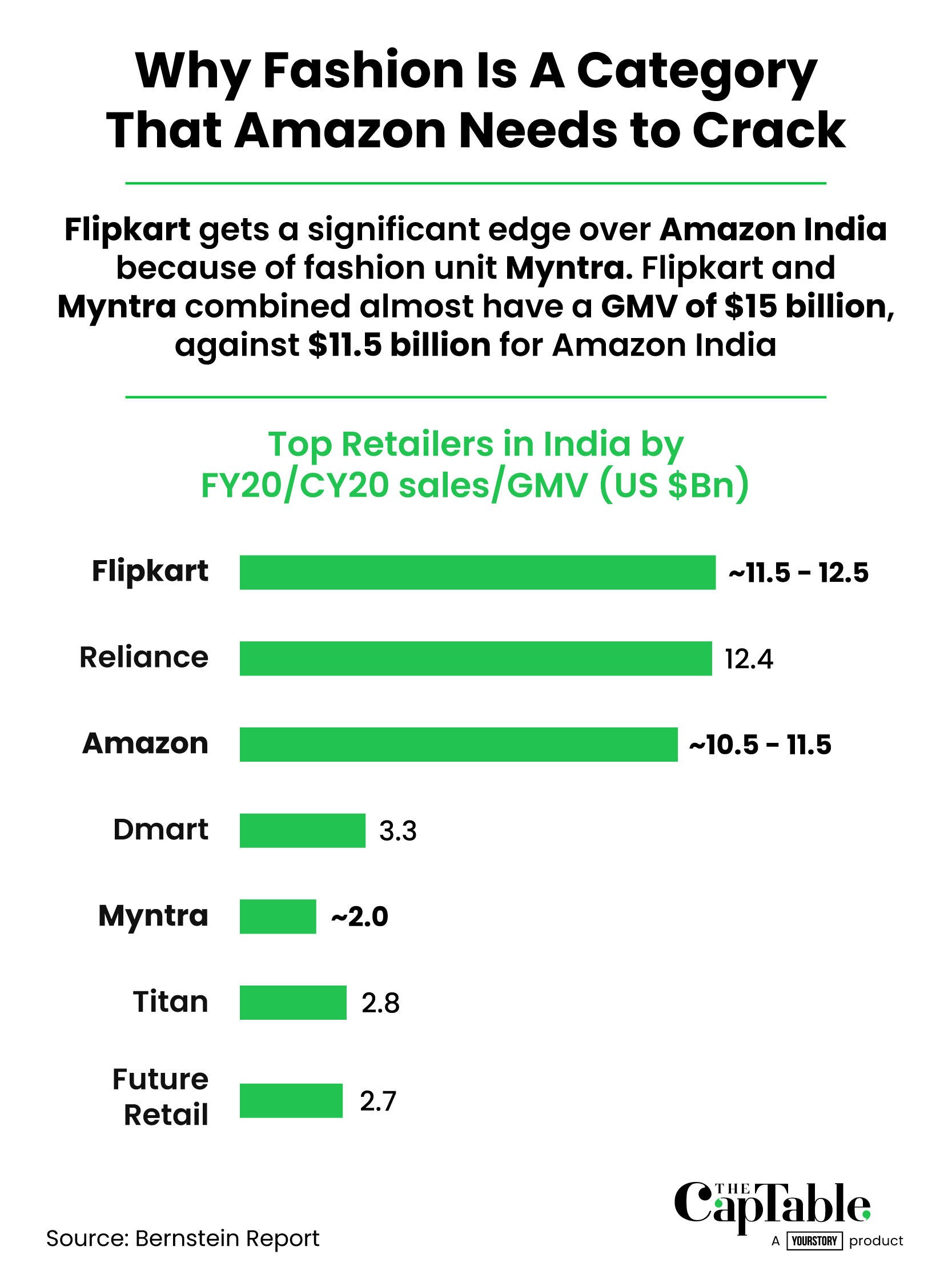

In India, Flipkart Group, which includes Myntra, commands 70% of the online fashion market, sources say. Reliance-owned Ajio is an upcoming player, with brands saying the company’s unique retail and online presence gives it leverage over pure-play online players.

Graphic: Winona Laisram

But why has fashion been a hard business for Amazon?

One reason for this is that the category is seasonal, making data-based forecasting of trends and warehouse capacity difficult. Another is that for fashion, shoppers prefer exploring and discovering the latest trends, something Amazon’s digital marketplace isn’t geared for.

To bolster its fashion portfolio in India, Amazon’s embarked on a three-pronged strategy, one that allows it to play to its strengths rather than have it fighting to cover its weaknesses.

LatestStories

OTT

Premium Reads

Reliance brings telecom's predatory pricing to OTT; will JioCinema's latest plans harm Netflix, Amazon?

By Sohini Mitter

E-commerce

Premium Reads

Be quick or be dead: BigBasket’s quick commerce evolution

By Pranav Balakrishnan

Investments

Premium Reads

Going solo: LPs want direct stakes in India's startup successes

By Nikhil Patwardhan

For subscribers only

Deeply reported and objective news on the country´s fastest-growing companies and the people behind them.

4 Min Read

Reliance brings telecom's predatory pricing to OTT; will JioCinema's latest plans harm Netflix, Amazon?

By Sohini Mitter

13 Min Read

Be quick or be dead: BigBasket’s quick commerce evolution

By Pranav Balakrishnan

12 Min Read

Going solo: LPs want direct stakes in India's startup successes

By Nikhil Patwardhan

13 Min Read

Sanjeev Bikhchandani on the rise of quick commerce, Zomato's turnaround, and state of Indian startups

By Sohini Mitter

12 Min Read

A year into bankruptcy, Go First’s case threatens to ground India’s aircraft leasing dreams

By Raghav Mahobe

12 Min Read

Udaan's getting smaller, its problems aren't

By Pranav Balakrishnan