Megha Jain is a homemaker, Laxman Mali a shopkeeper, and Vicky a student. They all reside in Jaipur and are members of various WhatsApp shopping groups run by DealShare. Jain uses the channel to buy for her family, Mali for his store, and Vicky for his own consumption.

“My friends also buy from DealShare,” said Jain, who relies on Reliance JioMart and DMart for her monthly basket but every once in a while makes a few purchases on DealShare as well. “It has decent prices and sometimes good offers.”

Mali buys some staples for his store from DealShare, where, he says, he gets better bargains than in the free market.

It’s this mix of customer segments in small cities and towns, primarily in Rajasthan, that carried DealShare to $200 million in gross sales run rate in fiscal year 2020-21.

Last week, DealShare said it had raised $144 million from Tiger Global, WestBridge Capital, Alpha Wave Incubation and Z3Partners. Most of the new capital will go into expanding pan-India.

“The question is, can DealShare replace DMart and local stores, or does it just supplement them?” said an investor closely tracking the space. (Reliance JioMart and DMart are DealShare’s biggest competitors.)

For two months, The CapTable, seeking an answer to this, closely tracked a few WhatsApp groups created by the company to seed its products in Jaipur.

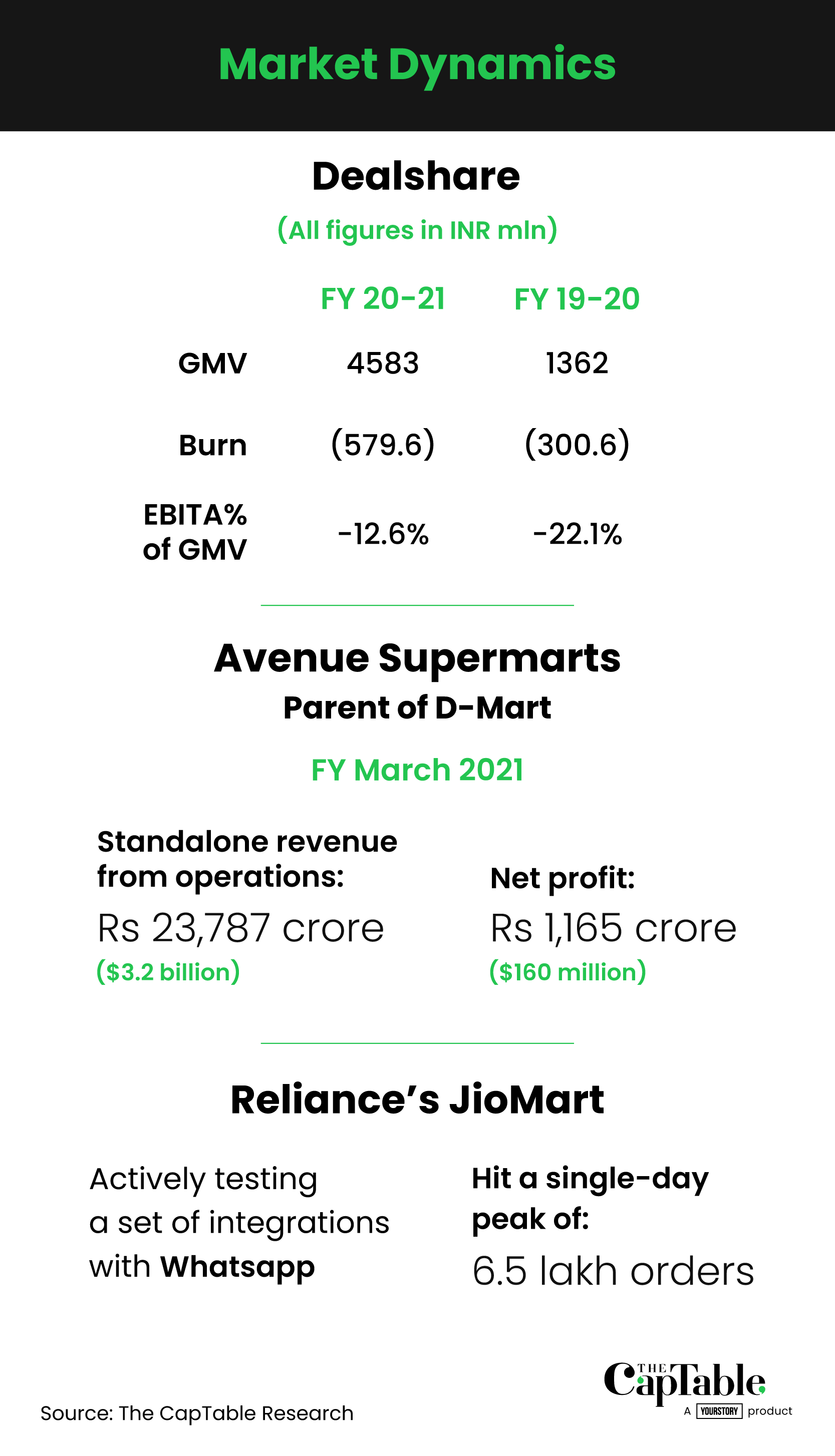

DealShare’s targeting a sales run rate of $1 billion by the end of this financial year—a 5x jump over its FY 2021 gross sales.

In comparison, Avenue Supermarts, DMart’s parent company, recorded standalone revenue from operations of Rs 23,787 crore ($3.2 billion) for the year ended March 2021, and a net profit of Rs 1,165 crore ($160 million). In the first quarter ended in June, revenue was up 31% from a year ago at Rs 5,031 crore ($680 crore).

Already a subscriber? Sign In

Be the smartest person in the room. Choose the plan that works for you and join our exclusive subscriber community.

Premium Articles

4 articles every week

Archives

>3 years of archives

Org. Chart

1 every week

Newsletter

4 every week

Gifting Credits

5 premium articles every month

Session

3 screens concurrently

₹3,999

Subscribe Now

Have a coupon code?

Join our community of 100,000+ top executives, VCs, entrepreneurs, and brightest student minds

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now