Since entering the unicorn club in April 2021, e-commerce unicorn Meesho has made big strides. The Bengaluru-based startup has scaled its business to over 100 million monthly users—roughly half the user base of Amazon and Flipkart—even as it has come close to matching India’s e-commerce heavyweights in terms of gross order numbers.

Armed with these headline-grabbing numbers, Meesho will head back to the private markets for a fresh fundraise in the coming months. For a company that has thus far raised over $1 billion, however, Meesho will likely find that investors aren’t nearly as quick to whip out their cheque books. Instead, they want to see how Meesho does in the upcoming festive season to see if its bets on a zero-commission, ad-first model, as well as new monetisation levers are holding up.

The most lucrative time of year for all e-commerce companies, Meesho’s fundraising will almost certainly be predicated on its performance over the next two months. The startup has told sellers that the tentative dates for festive sales this quarter will be 23-27 September, and 7-9 October.

“The [festive season] numbers will show if, going forward, it's a downround conversation or flat or even up… there are different scenarios being mapped out,” said a person directly aware of Meesho’s inner workings. Vidit Aatrey, Meesho’s CEO, is waiting to show output based on how this period pans out since the company still has funding gunpowder left over from its last fundraise, they added.

Indeed, the company has a number of holes to plug and capabilities to build before it can truly convince investors to part with their money. Especially since Meesho is positioning itself as a genuine rival to Amazon and Flipkart.

In an emailed response, a Meesho spokesperson acknowledged that the festive season is important for all e-commerce companies but added that Meesho doesn't operate in categories such as electronics and smartphones, which are heavily discounted during the festive season. "Given it is an important period and customer propensity to purchase is typically higher, we will focus on tapping into this demand in categories like fashion, home & kitchen, electronic accessories, among others."

This wouldn’t be the first time that Meesho has had to take a step back from fundraising discussions.

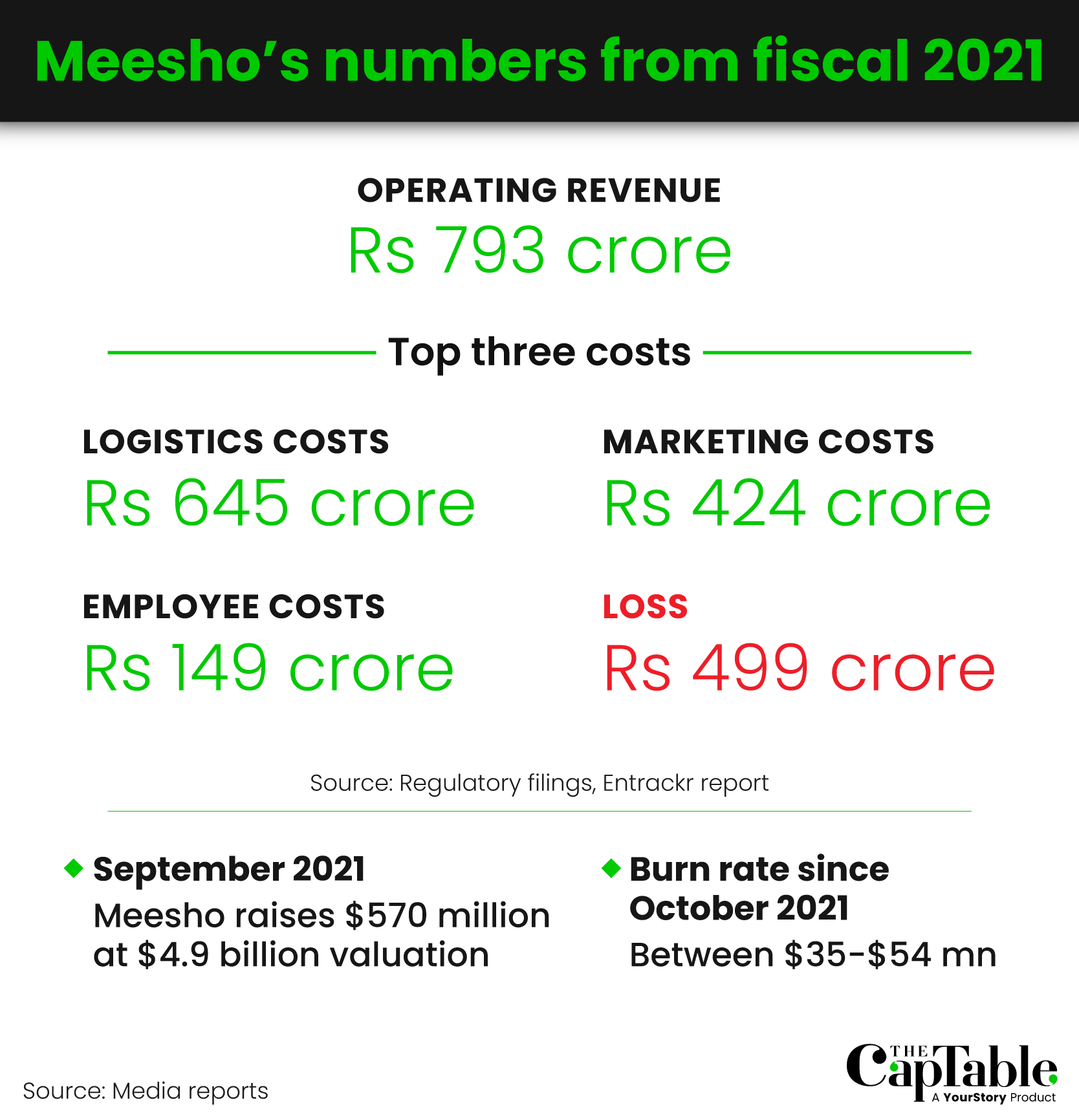

In December, The CapTable reported that Meesho hired investment bank Morgan Stanley to run a fundraising mandate of $500 million to $1 billion, at a valuation of $8 billion. The company backtracked on that fundraise after multiple investors rejected its valuation and capital ask, and decided to wait and see how it would execute on the plans it pitched. Luckily for Meesho, it had about $800 million in the bank at the time—more than enough to wait it out.

There’s a lot Meesho needs to do, including building a loyalty program that retains users and scaling to new categories beyond fashion. Beyond this, Meesho also needs to prove the mettle of its ads business and develop in-house tech capabilities to rationalise logistics costs to be recognised by investors as a competitor to big tech companies, said the person aware of Meesho’s inner workings quoted earlier.

“The last few months have just been spent bringing in these processes and stabilising the ship,” they added.

Now comes the crucial part—execution. Indeed, it wouldn’t be a stretch to say that Meesho now faces the most crucial quarter in its seven-year existence.

Graphic: Winona Laisram

Meesho is leaving no stone unturned in its attempts to make the most of the festive sales period. It is rolling out an aggressive marketing campaign starring actors Ranveer Singh, Deepika Padukone, and Ram Charan, former Indian cricket captain Sourav Ganguly, and comedian Kapil Sharma to expand the company’s top-of-the-funnel user base. It’s also piloting a loyalty program, called smart coins, in the hopes of boosting customer retention.

Even as Meesho goes all guns blazing on the consumer-facing front, it’s also looking to optimise how it runs the business at the backend as well. The company plans to rollout a logistics platform that has been developed in-house. The platform is expected to bring down the company’s logistics spends—one of Meesho’s largest cost centres—while also reducing Meesho’s reliance on large third-party logistics (3PL) companies.

The success of these initiatives will determine whether Meesho will have something to celebrate come the end of the festive season.

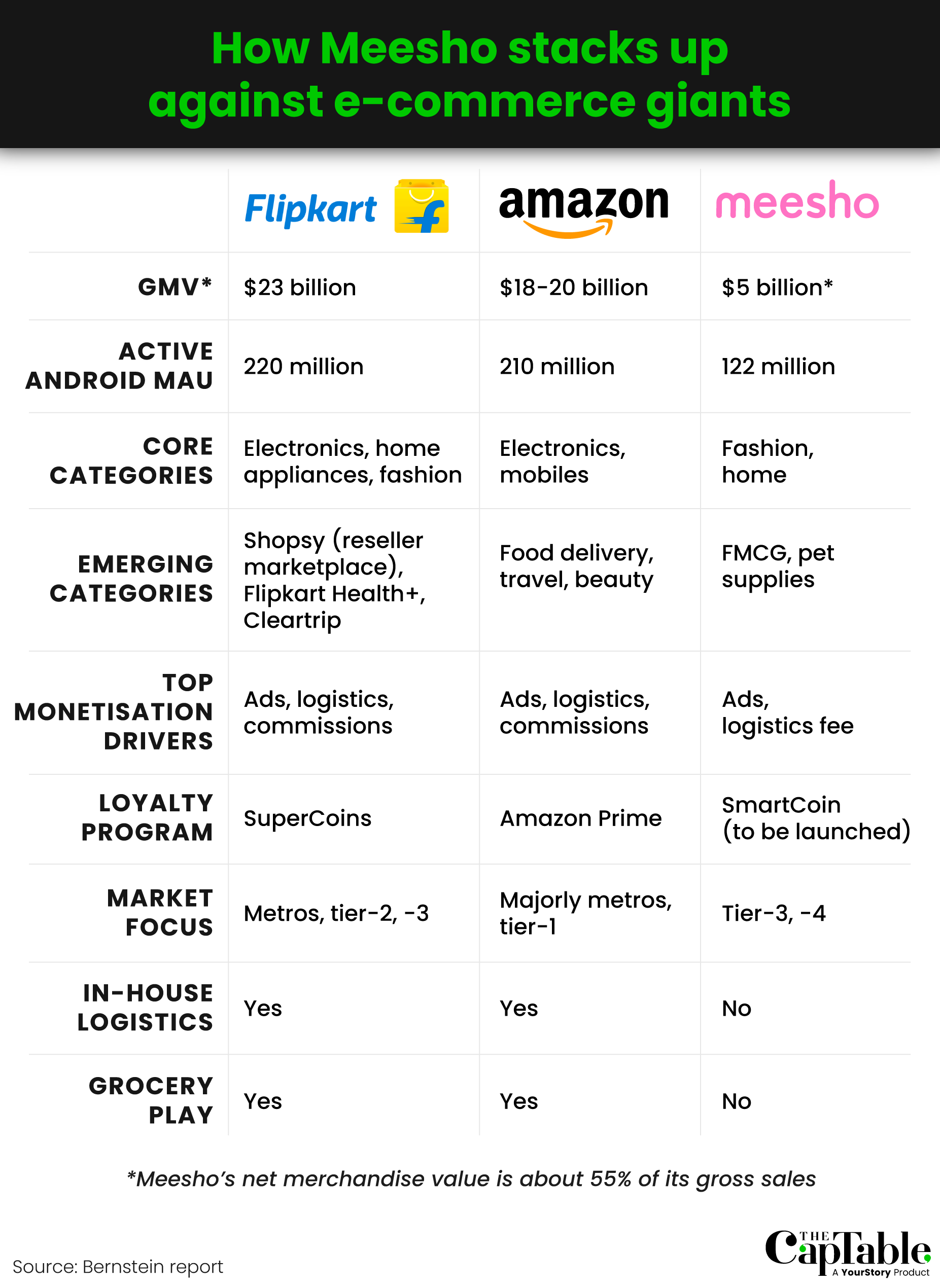

Meesho now has over 122 million active users on its app on a monthly basis, up from 56 million in September last year, according to app analytics firm data.ai. Of these, transacting users stand at about 35 million, one of the company’s investors told The CapTable. This is significant, as the two largest e-commerce companies Flipkart and Amazon hover at about 220 million monthly active users (MAU).

However, while Meesho is gaining ground in terms of users, it trails massively when it comes to revenue. For context, Flipkart closed the year ended March 2022 at $23 billion in annualised gross merchandise value (GMV)—a monthly GMV run rate of $1.9 billion. Amazon was at $18-20 billion, and Meesho at $5 billion, according to a report from research firm Bernstein.

This discrepancy isn’t surprising. Flipkart sells high-value items like smartphones and appliances, while Meesho is largely concentrated on fashion. Even so, investors believe that Meesho is missing a trick when it comes to driving repeat orders. The lack of a loyalty program and incentives to get customers back to the platform have hurt Meesho’s ongoing fundraising efforts as investors actively asked for this metric to benchmark the platform’s effectiveness.

“Shopee, Amazon, Alibaba, Walmart… Most e-commerce companies globally have some sort of a loyalty play. It’s one of the core capabilities for a platform to have as they scale to ensure the customer doesn't churn. Until now, this was not a priority at Meesho. The idea was to just expand the market base and do it quickly. This is now changing,” said a top executive at Meesho.

Meesho’s proposed loyalty program involves asking merchants on its platform to offer discounts of over 3% on their product catalogues. According to a seller memo sent by Meesho, merchants who agree to this would be featured on an exclusive section on the platform, potentially driving greater sales.

On the customer side, those who buy from these merchants would receive “smart coins” worth 8-10% of their purchase, which could be redeemed for discounts in the future. Meesho has communicated to its sellers that the programme will run from 13 September to 20 October, and would only be open to 5% of the platform’s customer base.

Through incentivising users, Meesho is hoping to do two things. The first and most obvious is, of course, to drive sales. The second, however, is equally important—improving the quality of its customer base. At present, Meesho’s net merchandise value (NMV)—sales after actual and provisioned returns and rejections—stands at 55% of its gross sales.

This is worrying, even for fashion, which sees returns as high as 30-35%. Meesho has struggled on this front for multiple reasons, including onboarding first-time customers and being plagued by fake orders. By driving repeat customers, Meesho hopes to improve its NMV.

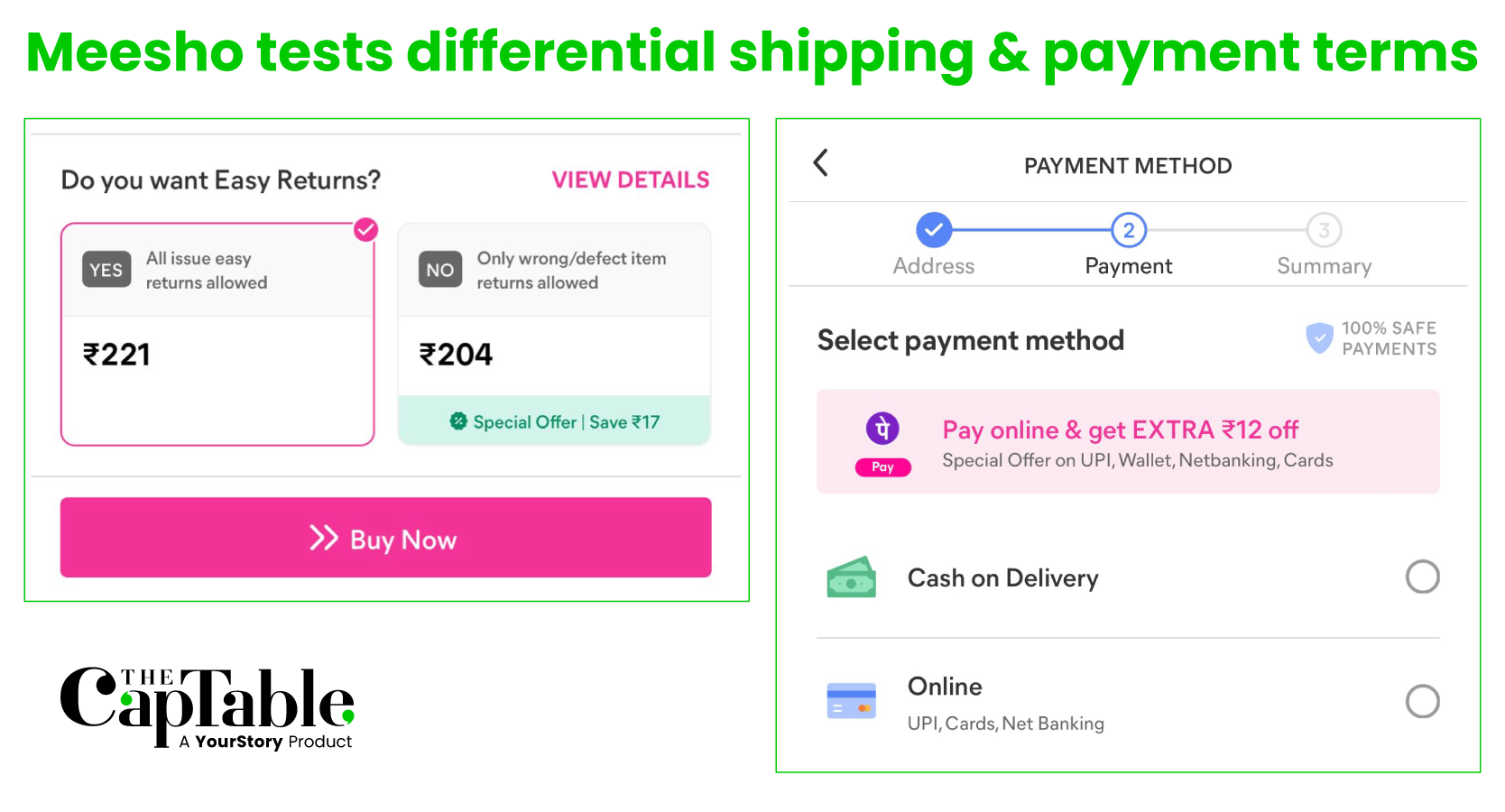

Meesho is also testing a new feature—offering customers pricing that’s lower by 2-7% but with the caveat of no returns for sizing and quality issues. Only defective or wrong orders would qualify for returns. Amazon and Flipkart often use a similar return policy for high-value items like smartphones and electronics.

The marketplace has also started incentivising users with a discount for making online payments instead of cash-on-delivery. These interventions cut the cost of order fulfilment by minimising the risk of order returns and cancellations.

While Meesho does not take a cut from sellers on its platform, ad revenue remains crucial. This is different from other large marketplaces, which make money via ads, commissions, as well as charging sellers for logistics. Today, Meesho’s sellers are spending, on an average, 2-3% of net sales on ads on the platform, a top executive at the company told The CapTable.

In March, Meesho’s monthly ad revenue run rate stood at $72 million ($6 million in the month).

Judith McKenna, Walmart International’s chief executive officer (CEO) and president, said in June that India is Walmart’s biggest market for advertisement revenue. Ad revenue constitutes 2-3% of Walmart-owned Flipkart's GMV. Amazon India’s marketplace service revenue stood at $320 million, while Flipkart stood at $174 million for the year ended March 2021.

Though the early signs from Meesho’s ad network seemed promising, investors are waiting to see how this metric pans out during the festive sales. “Meesho is at a reasonable scale now to make sense of the platform ad network. The festive season will be a good benchmark,” said an investor who evaluated Meesho in the past but did not invest at the time.

Meesho is also building its own courier management platform in a bid to get its logistics costs down by as much as 10-15%, according to people aware of the development.

Today, the cost of shipping is the biggest expense for the startup, which plays in a low average order value segment. And as sales growth has slowed, Meesho must find ways to keep this under check. In March, Meesho spent $25 million on logistics, according to data accessed by The CapTable.

The move is a significant development for the logistics ecosystem because Meesho has been one of the largest shipment clients for third party logistics companies. Meesho’s daily shipments peaked in January, touching a high of 1.5 million.

Thus far, Meesho has relied on full-stack 3PLs for end-to-end shipment delivery. A parcel assigned to, say, Delhivery, would have been serviced entirely by Delhivery, including pick-up, warehousing, mid-mile, and last mile. Meesho simply used the APIs of these businesses, integrating them with its seller dashboard.

With its new platform, this will change.

Meesho will now be able to dis-intermediate the whole logistics process, with its tech layer flowing through the process all the way from shipment pickup to returns.

Meesho will now look at several parameters to get the cost of shipment down. This could potentially result in Meesho assigning first mile pickup, mid-mile long haul, and last mile delivery to different partners, said the sources quoted above. “This is right now in the testing phase. Some flip-flops are happening. There are initial teething issues but gradually volumes are being moved to this [platform],” said a person directly aware of the move.

The move is significant for Meesho. In the year ended March 2021, logistics and fulfilment expenses—which stood at Rs 632 crore—accounted for 47% of Meesho’s overall costs. These costs are almost 80% of the Rs 793 crore revenue from sales Meesho saw that year. This is despite Meesho being able to extract better pricing from 3PLs since it accounts for a significant share of their volume. A Meesho spokesperson clarified that the company makes a 'reasonable gross margin' on this cost by charging its sellers a fulfilment and handling fee.

“Logistics burn was a big cost centre for them, but one they chose to allow for fast growth. Now as they look back, these processes are being made to keep them (logistics partners) a little bit in order,” said a second source with knowledge of the initiative.

The new logistics platform becomes especially important given that Meesho expects its number of shipments to grow to 1.2 billion in the year ending March 2023. Meesho said its total orders in the quarter ended June 2022 crossed 200 million.

It will also go someway to placating investors who aren’t convinced by Meesho’s approach to logistics thus far. The SoftBank-backed startup is the only large e-commerce company in the country that still doesn’t own a captive logistics arm. Others, including Amazon and Flipkart, continue to run their own inhouse supply chain units. Both Amazon and Flipkart have even opened up their in-house logistics operations to third-party aggregators like Shiprocket in a bid to utilise excess capacity in their network.

Meesho’s argument against this approach isn’t without merit. Unlike Amazon and Flipkart, which require in-house logistics since they handle expensive goods like electronics as well as large goods like furniture and home appliances, Meesho deals in low-ticket fashion and home furnishings that don’t require the same level of control. Besides, Meesho customers are more likely to be focused on cost than on delivery experience and timelines.

“What they want to show is that without building asset capabilities on the ground, the same level of control on shipments and service levels can be achieved with a maturing e-commerce logistics service layer. This launch will put that hypothesis to the test,” said a second investor in Meesho.

Nevertheless, this quarter will be a test of whether Meesho’s bold bets like zero seller commissions and low-value online play on an asset-light model truly works. “Scale, unit economics, technology backbone, and monetisation. Across all metrics, Meesho has left itself no room for error,” said an executive at the company.

This is a premium article and available only to subscribers.

What you get

Premium In-Depth Stories

5 articles every week

Archives

>3 years of archives

Newsletter

5 every week

Gifting Credit

5 premium articles every month

Visual Infographics

1 every week

Sessions

3 screens Concurrently

Most Popular

Most Popular

Have a coupon code?

Access unlimited content at a special discounted rate. Trusted by top VC’s and leading organizations, we provide bulk subscriptions for groups of 30+. Contact us for more details

Top educational institutions have collaborated with us for campus-wide subscriptions. For bulk campus-wide access, please get in touch.

Got a tip? If you have a lead we should be chasing at The CapTable, write to us at tips@the-captable.com

Join our community of 100,000+ top executives, VCs, entrepreneurs, and brightest student minds

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now