Key Takeaways

In early 2022, Swiss Commodities International (SCI), a sugar trading company based out of Chhattisgarh, saw a few of its trucks suffer accidents while transporting interstate cargo. Each truck was loaded with commodities worth Rs 10-12 lakh, and the damages would’ve been immense if the company did not have an insurance cover in place.

SCI Chairman Sanjay Laddha was aware of the risks associated with the trade of “high-value commodities” like sugar, spices, and tobacco, and had already booked a policy online. “We wanted to get commodity insurance, but while looking up on the internet, we came across marine insurance. Until then, we didn’t know that marine insurance also covered cargo transported via road,” he tells The CapTable.

Swiss Commodities went on to avail cargo insurance with a Rs 10-crore annual cover on PolicyBazaar. So far, the company has made 3-4 claims that have been settled by the insurance aggregator within 10-15 days of the accidents. “For us, the maths is really simple,” Laddha says. “We load 100 trucks and we’re paying a premium of Rs 18,000. That means each truck is getting covered in just Rs 170-180. Isse badi baat kya ho sakti hai (What could be better than this)?”

In another such instance, Delhi-based Supervac Industries, a manufacturer and exporter of vacuum pump oils, got its insurance claims settled within a month after its cargo was damaged in-transit off Mumbai’s JNPT port. The insurer assessed losses to the tune of Rs 60,000, and settled claims after the submission of proof of loss, bills of lading (the act of loading cargo onto a ship), and cargo receipts. (Supervac had taken a Rs 5-crore annual cover from ICICI Lombard.)

SCI and Supervac Industries are among a plethora of micro, small, and medium enterprises (MSMEs) in India that have woken up to the pressing need for marine insurance in today’s times, especially if the enterprise is engaged in interstate trade, in-land transfers, and import-export via rail, road, sea or air. This realisation was long overdue, say industry observers, and the COVID-19 pandemic has played a pivotal role.

With international ports closed, and air and land routes locked, tonnes of cargo and shipments remained stuck and/or damaged in untraceable locations for months at the start of the pandemic, the costs of the uncertainty ran into hundreds of millions of dollars.

Even domestically, trade and commerce via waterways is gaining more acceptance, with Amazon being the latest to partner with the Inland Waterways Authority of India to facilitate cargo shipments through rivers, canals, backwaters, and creeks.

While large corporate customers and those with global business exposure were already availing marine insurance—along with other business insurance products—the pandemic opened up the industry to countless small and micro enterprises.

Infographic: Nihar Apte

“The overall awareness around insurance products increased during the pandemic, especially for SMEs and MSMEs that remained shut for a very long time. They came to realise that in events like these, some of their business and operational risks could be covered by a policy,” Gaurav Arora, Chief of Underwriting & Claims Property & Casualty at ICICI Lombard General Insurance, tells The CapTable.

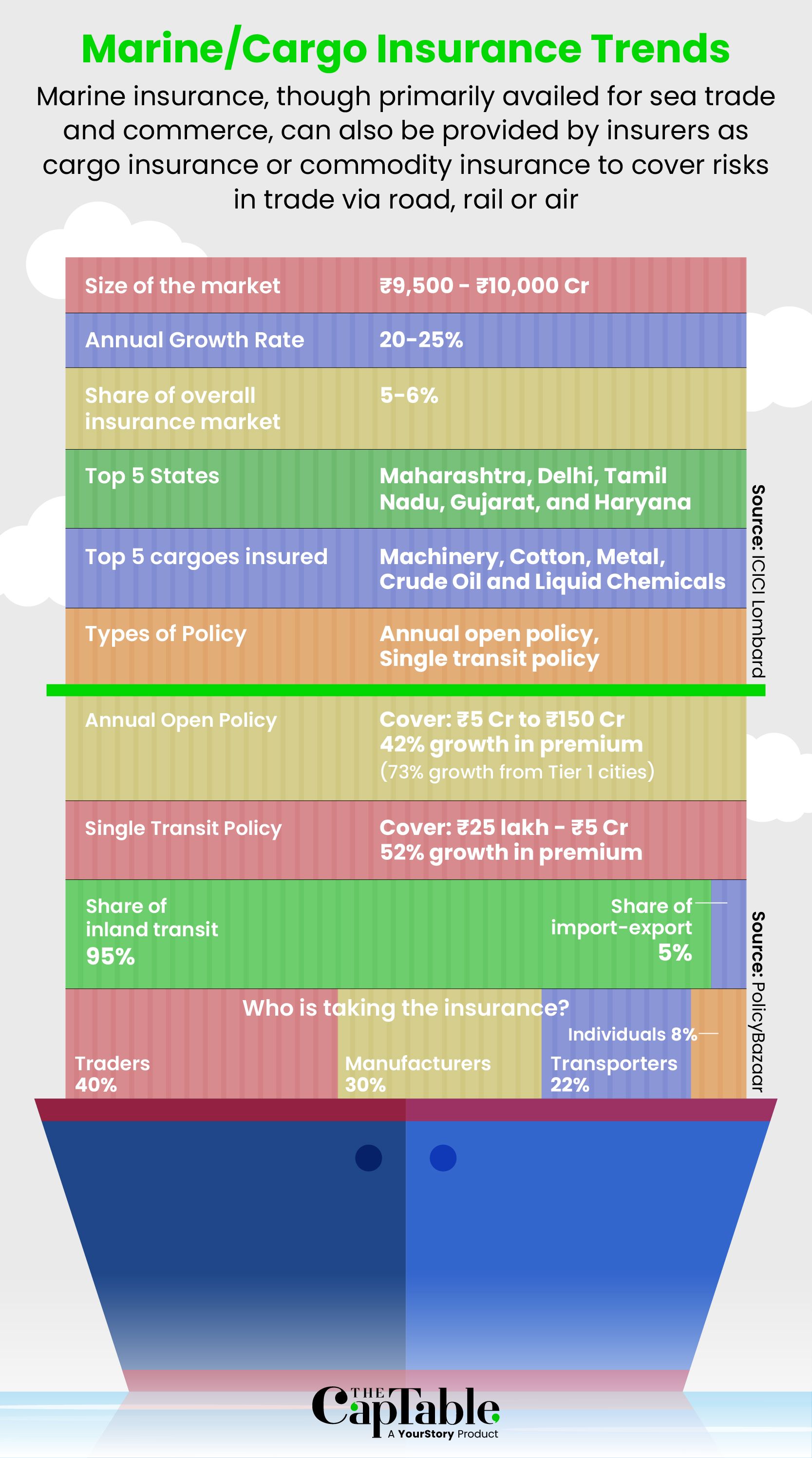

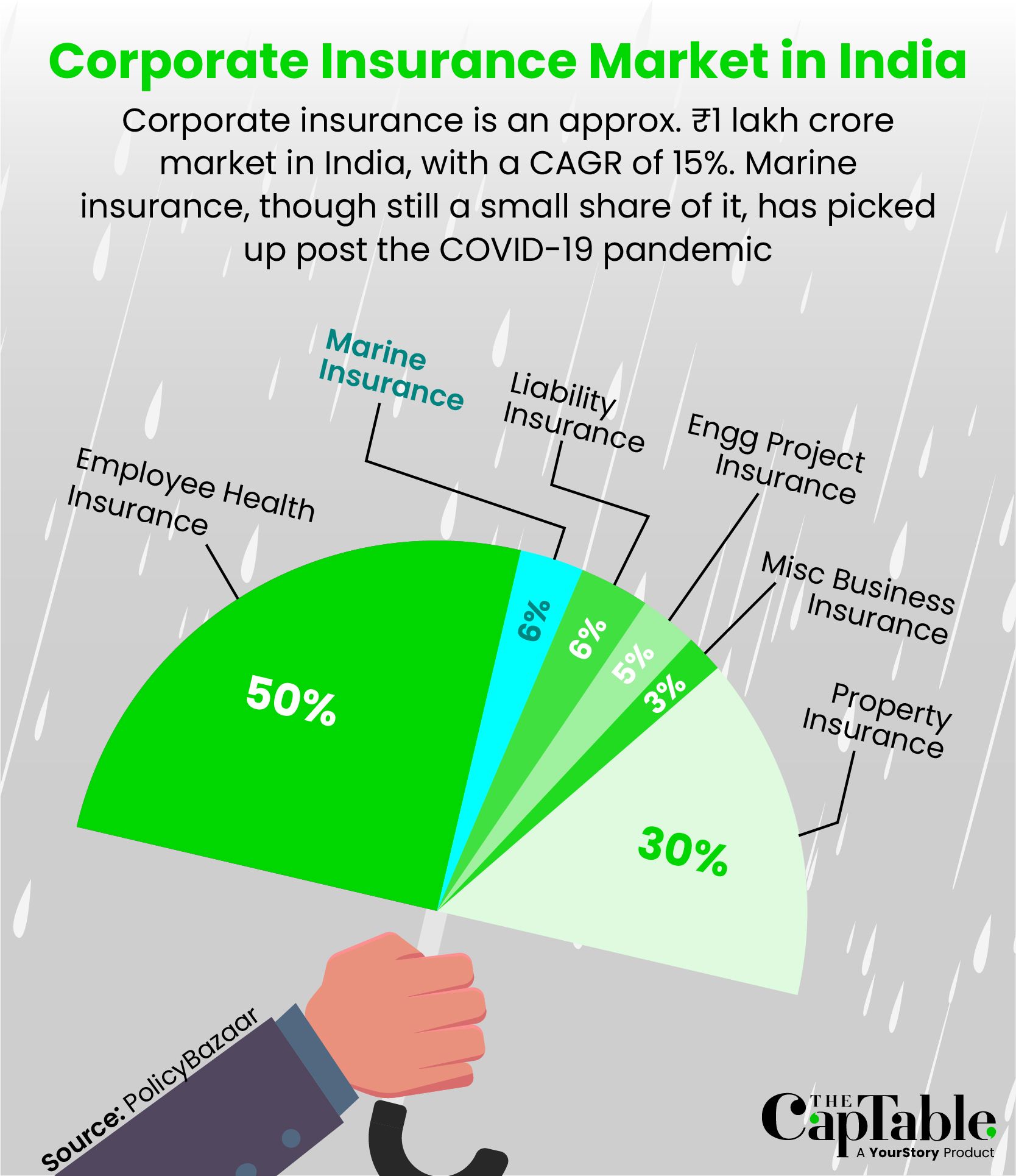

ICICI Lombard, with a 17% market share, is one of the oldest players in the marine insurance space. Even though this segment remains a small part (5-6%) of India’s overall commercial insurance market—with property premiums and group health premiums leading—there’s been a steady rise in demand for marine and liability insurance products in the last couple of years. Between March 2022 and March 2023, ICICI Lombard saw its premiums for this policy grow by 50%.

Arora says, “Given the current geopolitical scenario [with ongoing wars in Eastern Europe and the Middle East], as companies go more and more global, there’s a strict need for logistics and cargo insurance. Even the domestic market is doing pretty well from a manufacturing perspective. So, we’re seeing a lot of SME units wanting to opt for this particular business insurance to protect their cargo and shipping needs.”

At present, marine insurance is approximately a Rs 9,500-10,000 crore market in India and is growing at 20-25% annually. Cargo insurance is showing the maximum uptick among all products. (The others include hull insurance, freight insurance, liability insurance, and offshore/energy insurance.) India’s top insured cargo includes machinery, cotton, metal, crude oil, and liquid chemicals. These are followed by plastics, textiles, and various other small commodities. Insurance providers say that government initiatives like ‘Make in India’ and ‘Gatishakti’ are encouraging manufacturers of all sizes to avail of this insurance.

Demand is also pouring in from traders, ship/vessel owners, charterers, individual business owners, and even retail buyers who are opting for cargo covers while moving household goods from one location to another. Under India’s marine insurance policy framework, businesses can insure either single transits or an entire voyage from source to destination. They can also opt for an annual open policy, which covers every transit in a year.

On PolicyBazaar, annual open policies recorded a 42% growth in premiums in the last year. From tier-1 cities alone, this growth stood at 73%. Single-transit policy premiums, meanwhile, have grown by 52%. Queries for single-transit policies are also up by 60%.

Infographic: Nihar Apte

“Before the pandemic, there were very few insurers promoting this product. But now we’re seeing many more brokers and insurers coming into this segment because it is a simple product, and the terms and conditions aren’t that complex,” Sajja Praveen Chowdhary, head of PolicyBazaar for Business, tells The CapTable.

Simultaneously, search volumes and queries from customers are also up. “Earlier, MSMEs didn’t feel the need for this insurance because they hadn’t faced any business losses. Only the very risk-averse business owners who’d seen the benefits of other insurance products would likely opt for cargo insurance,” Chowdhary explains. “But post-COVID, this product has picked up due to word of mouth even in tier-3 cities.”

All leading general insurance players, including Bajaj Allianz, ICICI Lombard, Tata AIG, HDFC Ergo, Reliance General, Go Digit, Future Generali, Oriental Insurance, and New India Assurance, among others, offer this policy. The average sum assured ranges anywhere between Rs 1 crore to Rs 100 crore (usually availed by large corporates and e-commerce firms). MSMEs and individual buyers, meanwhile, can opt for covers as low as Rs 5-25 lakh. “If it’s a power plant importing coal, the sum insured would be much higher than, say, when an SME is transporting garments. They could do with a cover of a few lakhs. It all depends on the turnover of the company and the value of goods,” Arora explains.

Marine insurance policies can be customised for every cargo owner, transporter, and exporter. The premiums are determined based on 1) the type and value of cargo, 2) the mode of transportation, 3) routes and distance, 4) level of risk involved, and 5) whether the journey is to be undertaken within India or outside. It's a discussion between the insurer and insured.

Despite international sea trade bouncing back post the pandemic, India’s cargo insurance demand is mostly driven by in-land transfers via road, with Maharashtra, Delhi-NCR, Tamil Nadu, and Gujarat emerging as the top regions. Even though the Insurance Regulatory and Development Authority of India (IRDAI) does not mandate businesses to have cargo insurance, inflation costs and the increasing value of consignments are sending shipping and transportation costs through the roof, compelling businesses to think of potential financial losses.

“As trade evolves, so does the market. In the past, [premium] rates used to be 10X more and claims were 10X lower than what the market is experiencing now,” according to Ganeshan Mudaliar, AVP - Marine Cargo & Trade Credit Insurance at PINC Insurance. “Innovative extended covers and conditions have helped insured clients in their supply chain challenges and losses, protecting their balance sheets from both frequency and catastrophic losses,” he stated on LinkedIn.

Despite all this, however, several challenges persist.

Infographic: Nihar Apte

While a standard marine insurance policy covers untoward incidents like theft, vehicular collision, hijack, piracy, maritime fraud, train derailment, road accident, natural disasters, explosions, wars, riots, etc., in events such as damage to goods due to unsuitable or insufficient packaging or cargo damage due to an unfit vessel/ship, the insurance provider can reject the claims. There’s also the problem of fraudulent claims, non-disclosure of information, delayed reporting, and sometimes, even intentional damage to cargo to extract money from the insurer.

Add to this, domestic insurance providers often find themselves challenged when it comes to covering complex risks. For instance, insurance for Russian imports (like crude and fertilisers) is not available in the Indian market. “Even though the consignments have grown more than 50%, premiums have fallen 25%, and now Russian exporters are taking policies at their end before they enter India,” Arora shares.

Globally, though, marine insurance continues to be a major finance product, with a significant amount of premiums attached. The market is projected to reach $33.9 billion by 2028, according to Allied Market Research. “Rapid growth in incorporation of Internet of Things (IoT), which helps in risk monitoring, simplifies claims processing, and facilitates loss prediction and prevention is expected to provide lucrative opportunities to the marine insurance market in the coming years,” the report stated.

In India, meanwhile, insurance operators believe that more awareness creation will benefit the sector and help attract new customers. “The mutual funds industry has done a great job in this regard,” according to Arora. “To a large extent, most people still don’t know about the protections that exist in marine and cargo insurance. The awareness has to be created by the ecosystem, which includes not just the insurance providers, but also government agencies like CII and FICCI,” he says.

Despite the recent uptick, marine insurance is far from being the top-bought corporate insurance product in the country. But with a ‘China+1’ approach pushing more and more companies to look at India as a global trade and manufacturing hub, the growth opportunity that lies ahead is enormous.

“Following Europe, APAC is projected to register the highest growth rate [in marine insurance] owing to the rapid economic growth in countries like India and China, along with the booming manufacturing industry in these regions,” reads a report by BlueWeave Consulting and Research.

The Indian government, meanwhile, aims to increase exports to $2 trillion by 2030, as part of its New Foreign Trade Policy, which will further benefit this sector. ONDC too could play a key role in expanding the market with higher transportation of goods, say experts.

All things considered, this could be the best time to be a marine insurance provider… and buyer.

(Cover image: Sharath Ravishankar)

Edited by Ranjan Crasta

Got a tip? If you have a lead we should be chasing at The CapTable, write to us at [email protected]

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now