Key Takeaways

Recently, reports surfaced that ports-to-power conglomerate Adani Group would enter the regulated payments sector. This speculation even forced listed payments entity Paytm to declare to the stock exchanges that reports about its founder Vijay Shekhar Sharma discussing a potential stake sale with the Adanis were untrue.

Adani isn’t the only Indian conglomerate making a belated entry into the payments space. Mukesh Ambani-led Reliance Industries has already forayed into the space with Jio Financial Services in 2023. With their vast resources, extensive business networks, and deep understanding of the Indian consumer, these conglomerates have the potential to introduce innovative financial products and services that could attract a substantial user base. Their entry could intensify competition, pushing existing players to enhance their offerings and improve customer service.

However, the success of Adani and Ambani in this space is not guaranteed. They, too, must navigate regulatory challenges, establish trust with consumers wary of new financial entrants, and differentiate themselves in a market already dominated by established players such as Google Pay, PhonePe, and Paytm. Their ultimate impact will depend on how seamlessly they integrate these services into their broader business ecosystems and deliver superior value to consumers.

Infographics by Sharath Ravishankar.

Besides, while digital payments have emerged as a crucial component of the Indian financial ecosystem, it remains a cash-burning business characterised by significant customer acquisition costs, low margins, and an overall drag on profitability. In India, regulations prohibit charging consumers for these services, further compressing potential revenue streams. Consequently, B2B companies within the digital payments space are more profitable than their B2C counterparts, leveraging scalable business models and institutional partnerships to generate revenue.

The Adanis and Ambanis have a unique advantage in this regard. With their expansive war chests, these corporate giants can afford to invest heavily in the digital payments sector, absorbing initial losses as they build market share. They can either build their digital payment platforms organically, leveraging their extensive infrastructure and consumer base, or strategically acquire established entities that have already garnered RBI approval and market acceptance but require additional capital to scale.

Both Adani and Reliance wield an extensive array of businesses that directly engage with consumers' spending habits. Their strategic positioning across traditional and new-age sectors primes them to become major players in India's burgeoning embedded finance landscape, potentially establishing a duopoly that reshapes the nation's financial services sector.

Reliance Retail—the retail-focused subsidiary of Reliance Industries—commands one of the country's largest chains, spanning groceries, electronics, and fashion. In contrast, while the Adani group is largely B2B-focused, it touches consumers through the group’s airports and CNG pumps, not to mention its fast-moving consumer goods joint venture Adani Wilmar, which is a staple in Indian pantries.

The Reliance stable also boasts Reliance Jio, which revolutionised India's telecommunications sector and boasts the largest subscriber base in the country, while Jio Financial Services recently unveiled its latest offering, the ‘JioFinance’ app. The app, currently in its beta phase, caters to users of all levels of familiarity with financial technology, providing convenient money management solutions at their fingertips.

The JioFinance app’s key features include digital banking, UPI transactions, bill settlements, insurance advisory, and a consolidated view of accounts and savings, all seamlessly integrated into a single application. The app also offers instant digital account opening and streamlined bank management, enhancing user experience and convenience. Future plans include the expansion of loan solutions, starting with mutual fund loans, to meet the diverse financial needs of users.

Jio Financial Services aims to simplify the entire spectrum of financial services on a single platform, catering to users across all demographics. In essence, Jio Financial Services aspires to become the go-to platform for all Indians’ financial needs. Leveraging Jio's telephony services and robust data insights on Indian consumers, the company is well-positioned to offer customised and personalised financial solutions tailored to individual preferences and requirements.

Adani's footprint in energy and utilities, including electricity and gas distribution, presents additional opportunities for consumer engagement. Integrating financial services with utility bill payments or offering energy-efficient financing options further deepens consumer relationships.

The Adani Group, though, exited the NBFC space last year, with Bain Capital buying out its stakes in Adani Housing and Adani Finance. The group also hasn’t had any success in financial services acquisitions so far. However, the Adani Group is keen to diversify into the fast-growing e-commerce and payments segments.

This move aligns with the conglomerate's strategy to expand its presence in sectors with significant growth potential. With a direct entry into households through its power distribution business and its increasing and expanding FMCG business, it can widen its business canvas with this digital intersection.

Recently, Adani launched co-branded credit cards with established players such as ICICI Bank. These partnerships provide access to established payment networks and enhance the credibility of Adani's financial offerings. Adani aims to consolidate its digital services through its super app, Adani One, which was launched in 2022. This integration enables seamless access to payment services alongside other digital offerings, enhancing the user experience and driving engagement.

Adani's acquisitions in the travel retail sector, including Flemingo Travel Retail and Cleartrip, highlight its focus on bolstering travel services. Cleartrip's integration as the Group's online travel aggregator enhances the value proposition of Adani's digital ecosystem, attracting users with comprehensive travel booking services. Its recently launched co-branded cards are also travel-focused, seeking to leverage this presence as well as take advantage of the various Adani-owned airports across the country.

Beyond this, Adani's ventures into green hydrogen, energy, and data centres, alongside Ambani's diversified interests, provide additional touchpoints for consumer engagement.

Looking at these large conglomerates, their individual competitive streaks, and parallel efforts in this space have the potential to reshape the financial services sector, offering consumers unprecedented convenience and choice in managing their finances.

Further, these conglomerates’ deep pockets enable them to attract top talent and provide lucrative incentives to build innovative businesses from the ground up.

Just as Reliance did in their retail ventures, they can leverage global partnerships, akin to Jio's collaboration with Blackrock, to bring in expertise and knowledge from around the world. While this heightened competition may ultimately benefit consumers through improved services and lower costs, it also raises concerns among competitors and regulators regarding market concentration and fairness.

India's burgeoning market, with its vast population, expanding economic base, and rising per capita income, presents an irresistible opportunity for global players seeking growth and expansion. With approximately a sixth of the world's population, India offers a massive consumer base hungry for goods and services across various sectors.

In this landscape, Ambani's Reliance and Adani's conglomerate stand out as the potential business partnership gatekeepers with the largest pockets, the most ambitious visions, and access to the largest consumer base. Their formidable presence across multiple industries, from retail to telecommunications to energy, positions them as key players shaping India's economic trajectory.

As India continues its journey towards becoming a global economic powerhouse, the influence and reach of Ambani and Adani are expected to grow even further. Their extensive resources, combined with their strategic vision, superior project management and execution capabilities, and deep understanding of the Indian market make them formidable competitors for both domestic and international players alike.

Adani and Ambani possess the financial muscle to not only challenge but potentially disrupt the dominance of American-owned entities in India's payments sector. Their vast resources enable them to leverage the payments business and B2B services to facilitate global business enablement. While success in financial services isn't solely bought with money, their substantial financial backing combined with their policy influence can attract top talent and expertise, enhancing their chances of success.

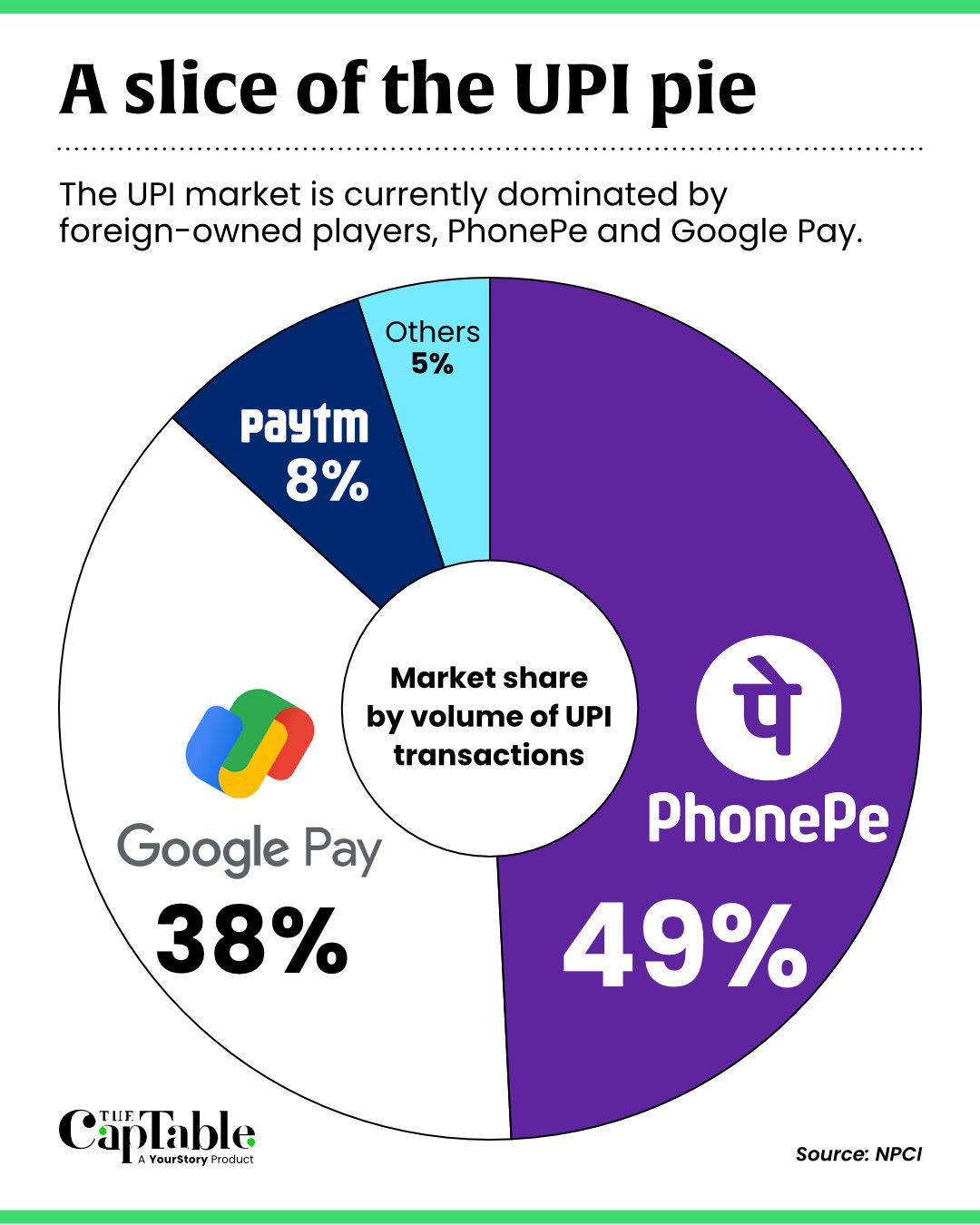

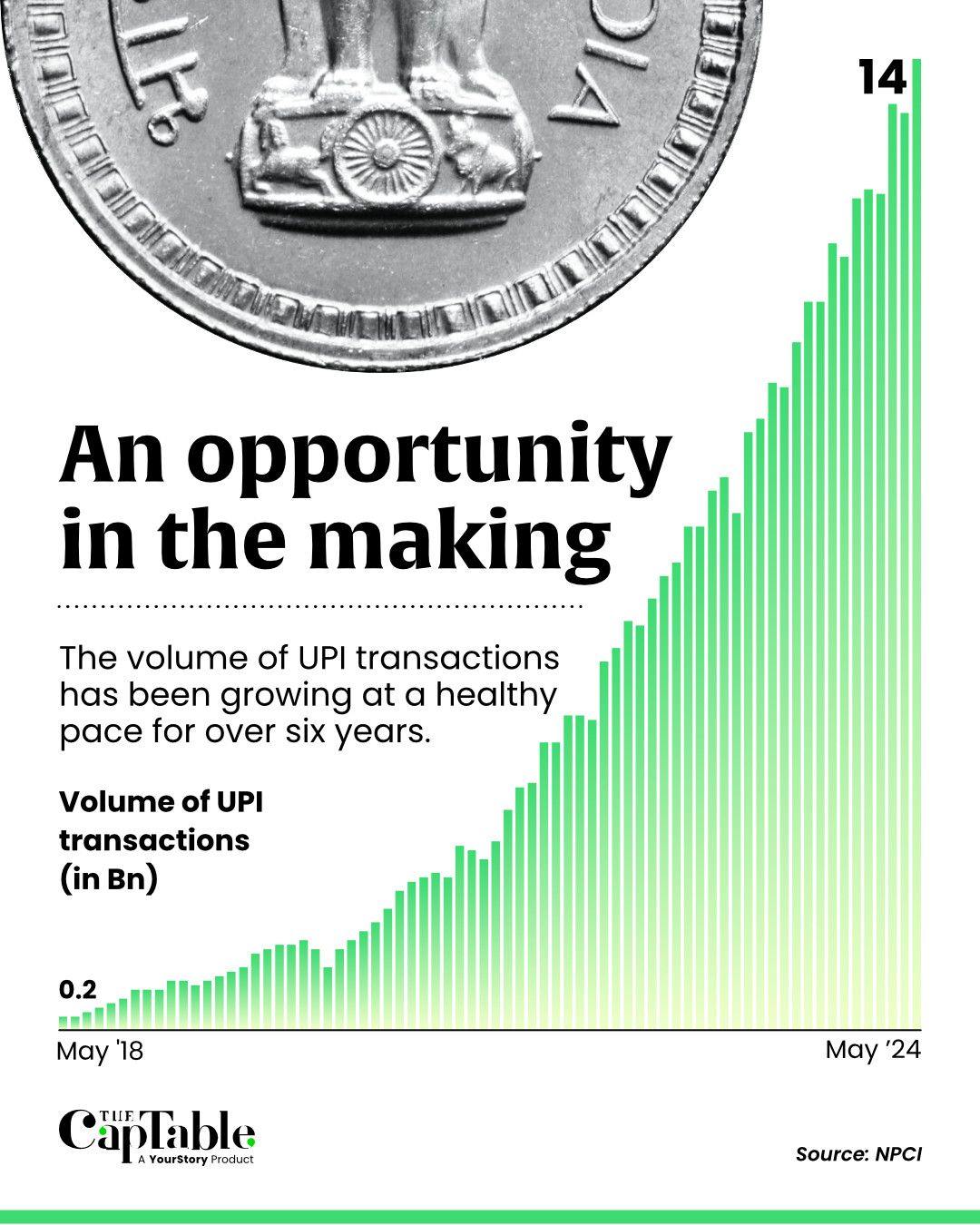

Walmart's PhonePe and Google Pay currently reign over India's mobile payments market, jointly processing a staggering 86% of all transactions on the UPI network, which handles over 12 billion transactions monthly. Despite concerns from competitors and government bodies regarding Google and Walmart's growing market share, regulators have yet to intervene.

Infographics by Sharath Ravishankar.

Adani and Ambani's entry into the payments space introduces a formidable challenge to this duopoly and could probably even create a new duopoly. With their financial prowess and potential policy influence, they can not only compete but also innovate, potentially reshaping the landscape of India's mobile payments market. Their emergence is likely to prompt a reevaluation of market dynamics and regulatory oversight in the near future, especially with regard to anti-competition rules.

While Adani Group has already rolled out its super app, Reliance is yet to do so. Its loyalty programme, coincidentally called Reliance One, however, is already integrated across the conglomerate’s various consumer-facing platforms, leading many to believe Reliance’s super app offering isn’t far away.

Building a successful super app for all or most Indians, though, is an unprecedented feat. The diverse and highly fragmented nature of the Indian market adds a confounding layer of complexity, making it wiser to attempt to build an embedded finance ecosystem instead.

By focusing on integrating financial services into existing platforms, companies can leverage their existing consumer trust and technological capabilities without the immense challenge of creating a fully-integrated super app. This approach could provide a more practical pathway to achieving significant digital engagement and financial inclusion.

Over a century ago, banks were the quintessential one-stop shops for all financial needs, providing a comprehensive suite of services from deposits and loans to investments and insurance. However, technological advancements and changes in distribution channels have fragmented these services, leading to the rise of specialised financial entities. Today, digital finance is poised to bring about a new era of banking through embedded finance in a consumption-driven economy.

By integrating financial services directly into the platforms where consumers are already active—be it shopping, socialising, or using various online services—embedded finance offers a seamless, contextual, and highly personalised financial experience. This approach not only meets consumers' financial needs more intuitively but also capitalises on the vast data and reach of digital ecosystems, suggesting that the future of banking may well lie in these integrated digital solutions rather than traditional standalone financial institutions.

In the 21st century, the allure of a universal banking license, which traditionally allows institutions to offer a broad array of financial services under one roof, might be replaced. Instead, corporate houses might increasingly see control over digital ecosystems, data, and consumer behaviour as the new frontier for banking-like services. This shift is driven by the understanding that digital platforms can deliver financial services more efficiently and with greater reach than traditional banking structures.

Controlling a digital pipeline enables corporations to leverage their existing customer base and vast amounts of data to tailor financial offerings precisely to consumer needs. With sophisticated data analytics, companies can understand consumer behaviour in real-time, predict financial needs, and offer personalised products. This capability enhances customer experience and increases the likelihood of consumer retention and loyalty, which is crucial for long-term success in financial services.

For corporate houses, this digital-first approach represents a strategic advantage. By embedding financial services within their broader ecosystem, companies can create seamless experiences that integrate lending, mutual funds, and insurance into their existing consumer touchpoints. For instance, an e-commerce giant can offer financing options at the point of sale, or a telecom company can provide micro-loans and insurance products through their mobile platforms. These embedded finance solutions reduce friction for consumers and can be delivered with minimal additional infrastructure compared to setting up a traditional bank.

Moreover, the regulatory environment has become more accommodating towards non-banking entities entering the financial services space through partnerships and innovative financial technologies (fintech). Corporate houses can offer lending services, mutual funds, and insurance products through third-party tie-ups, circumventing the need for a universal banking license while still capturing significant market share in these segments.

Additionally, obtaining specialised licenses for particular financial services can be more practical and less burdensome than acquiring a universal banking license, which comes with stringent regulatory oversight and capital requirements.

For example, companies like Jio and Adani could leverage their extensive digital and physical infrastructure to create comprehensive financial ecosystems. Jio, with its massive telecommunications network, can integrate mobile banking, payments, and financial products directly into its service offerings, providing unparalleled convenience to its users. Similarly, Adani’s diverse business interests and digital initiatives could enable it to offer a range of financial services tailored to the needs of its varied customer base, from industrial clients to everyday consumers.

While the integration of financial services into digital ecosystems promises convenience and innovation, there is a significant cautionary aspect to consider. If digital supremacy is concentrated in the hands of a few dominant entities, akin to the current landscape with big tech companies, it raises critical questions about the ability of financial regulators to effectively control or steer these powerful conglomerates. The vast data access and influence these entities wield could outpace traditional regulatory frameworks, making oversight and enforcement challenging.

Moreover, the potential for monopolistic practices, data privacy concerns, and systemic risks could increase, as these entities might prioritise profit and market dominance over consumer protection and financial stability. Therefore, regulators must proactively evolve and implement robust, agile frameworks to ensure these digital giants operate within safe and fair boundaries, preserving the integrity and stability of the financial system while safeguarding consumer interests.

Do regulators possess the digital expertise necessary to effectively supervise such technologically sophisticated entities? This may soon be put to the test.

Edited by Ranjan Crasta

Got a tip? If you have a lead we should be chasing at The CapTable, write to us at [email protected]

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now