Sign In

What Tata, Reliance and Swiggy see in 6am deliveries

Aditi Shrivastava

Aditi Shrivastava

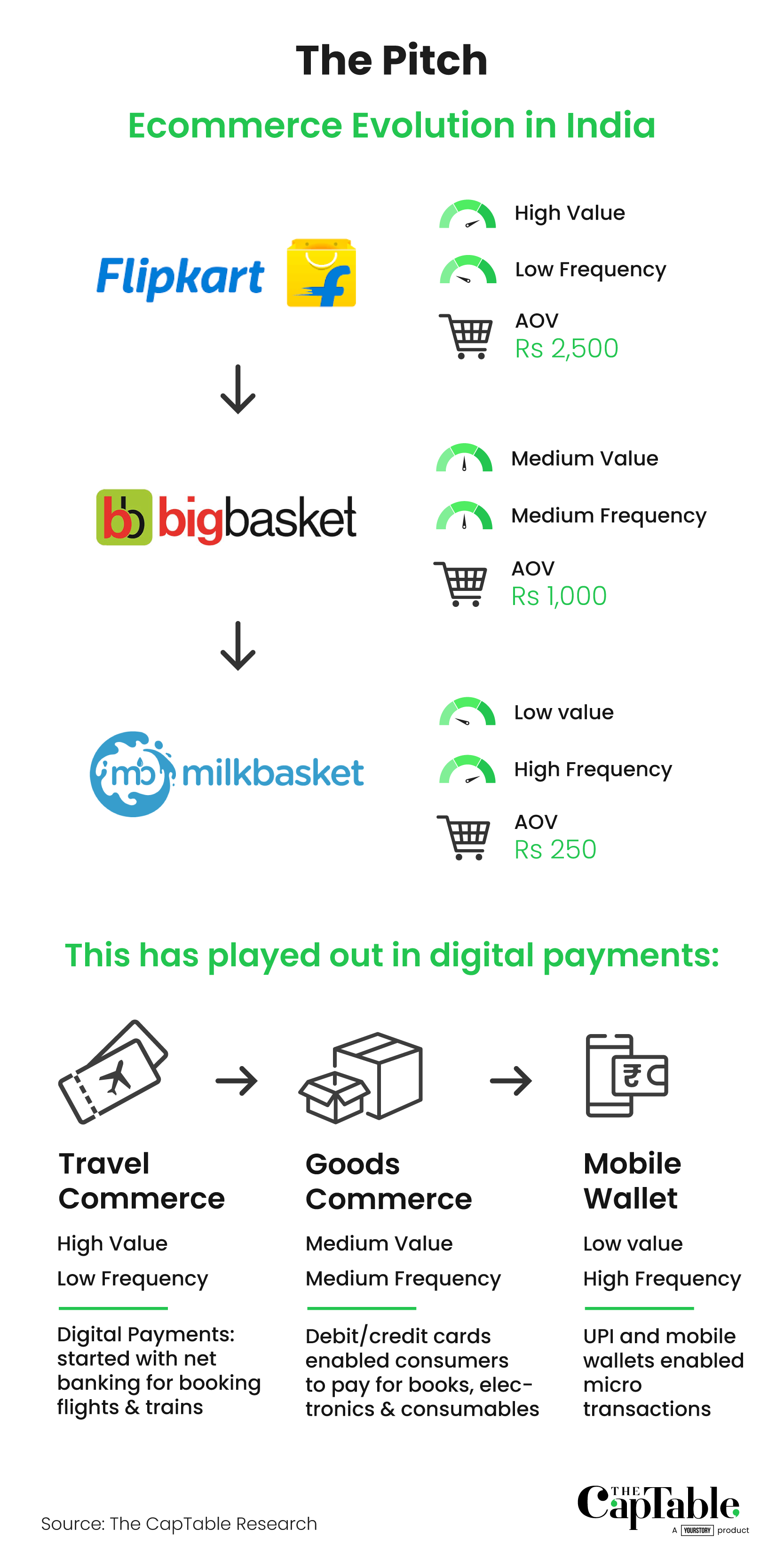

The early morning milk and grocery delivery segment fizzled out and consolidated even before it could scale up. But with Tata Group, Reliance and Swiggy now dominating a category that had a growth spurt during the pandemic, Amazon India and Flipkart may have missed milking an opportunity

June 30, 2021

9 MINS READNot too long ago, there were about 20 startups trying to replace the neighborhood vendor delivering milk packets to your door every morning. Now, it’s a three-horse race.

Two of the contenders are India’s largest business conglomerates, Tata Group and Reliance Industries. As they build their own digital empires, they see in morning deliveries a powerful distribution channel leveraging their supply chain capabilities built over decades.

The third is Swiggy, which entered the morning milk and grocery delivery sector through its acquisition of Supr Daily three years ago. Reliance is in its last leg to purchase Milkbasket this year after months of deliberations, and Tata last month bought BigBasket, which operates BBDaily.

Most of the other startups in this space, such as DailyNinja, Doodhwala, RainCan and Morningcart, have either folded or been acquired. A few remaining ones, such as Country Delight, are smaller in operations.

The business of digitizing morning milk deliveries holds great promise for online grocery deliveries, a sector that has been experimenting, not always successfully, with multiple models. The 6 am deliveries model offers a ready platform for repeat business, one that can be expanded to get customers to add other products to their daily baskets along with milk.

“Grocery is a classic category for subscription-based purchase models because of repeat orders and product brand stickiness,” said Rahul Malhotra, Senior Analyst at Bernstein, in a report. Malhotra highlighted how the model enables retailers to better forecast demand and delivery schedules.

Investors including Sequoia Capital, Matrix Partners, Omnivore and Kalaari have poured in about $100 million into the morning deliveries category. But none of the startups has managed to scale up operations independently.

Some experts say the margin structure never allowed for it, while others blame an obsession with hyper growth. “The underlying assumption in backing this sector was that over time you would get a large basket size (over Rs 500) but I don’t think anybody has been successful,” said an investor in the sector.

“It’s a capital-intensive and longterm commitment game,” said another investor. “Not many have the appetite or the capability to build it barring, say, five big companies in the country.”

With Tata Group and Reliance now in the business, the category gets a huge leg-up in backend sourcing and fulfilment capabilities. Their timing may be just right, with the pandemic lockdowns driving greater adoption, especially among apartment-dwellers.

LatestStories

E-commerce

org-charts

The hands steering Shiprocket's evolution from shipping platform to e-commerce enabler

By Gaurav Tyagi

Aviation

Premium Reads

A year into bankruptcy, Go First’s case threatens to ground India’s aircraft leasing dreams

By Raghav Mahobe

E-commerce

Premium Reads

Udaan's getting smaller, its problems aren't

By Pranav Balakrishnan

For subscribers only

Deeply reported and objective news on the country´s fastest-growing companies and the people behind them.

12 Min Read

A year into bankruptcy, Go First’s case threatens to ground India’s aircraft leasing dreams

By Raghav Mahobe

12 Min Read

Udaan's getting smaller, its problems aren't

By Pranav Balakrishnan

11 Min Read

Funding for Indian startups is back*

By Nikhil Patwardhan

6 Min Read

RBI’s muted monetary policy: The calm before potential summer storm

By Dr Srinath Sridharan

10 Min Read

Betting on bundles: Why OTT aggregators are becoming all the rage

By Sohini Mitter

10 Min Read

As financial institutions scramble to comply with RBI’s ESG mandates, is the reporting ecosystem ready?

By Gaurav Tyagi