Sign In

Can the Tata Neu app be India’s ‘Everything Store’?

Sohini Mitter

Sohini Mitter

Tata Neu may have finally put its glitchy start in 2022 behind, riding on some structural changes, co-branded credit cards, and an aggressive IPL marketing effort. Here’s what’s brewing at the platform that claims to be India’s first true super app.

June 19, 2023

13 MINS READKey Takeaways

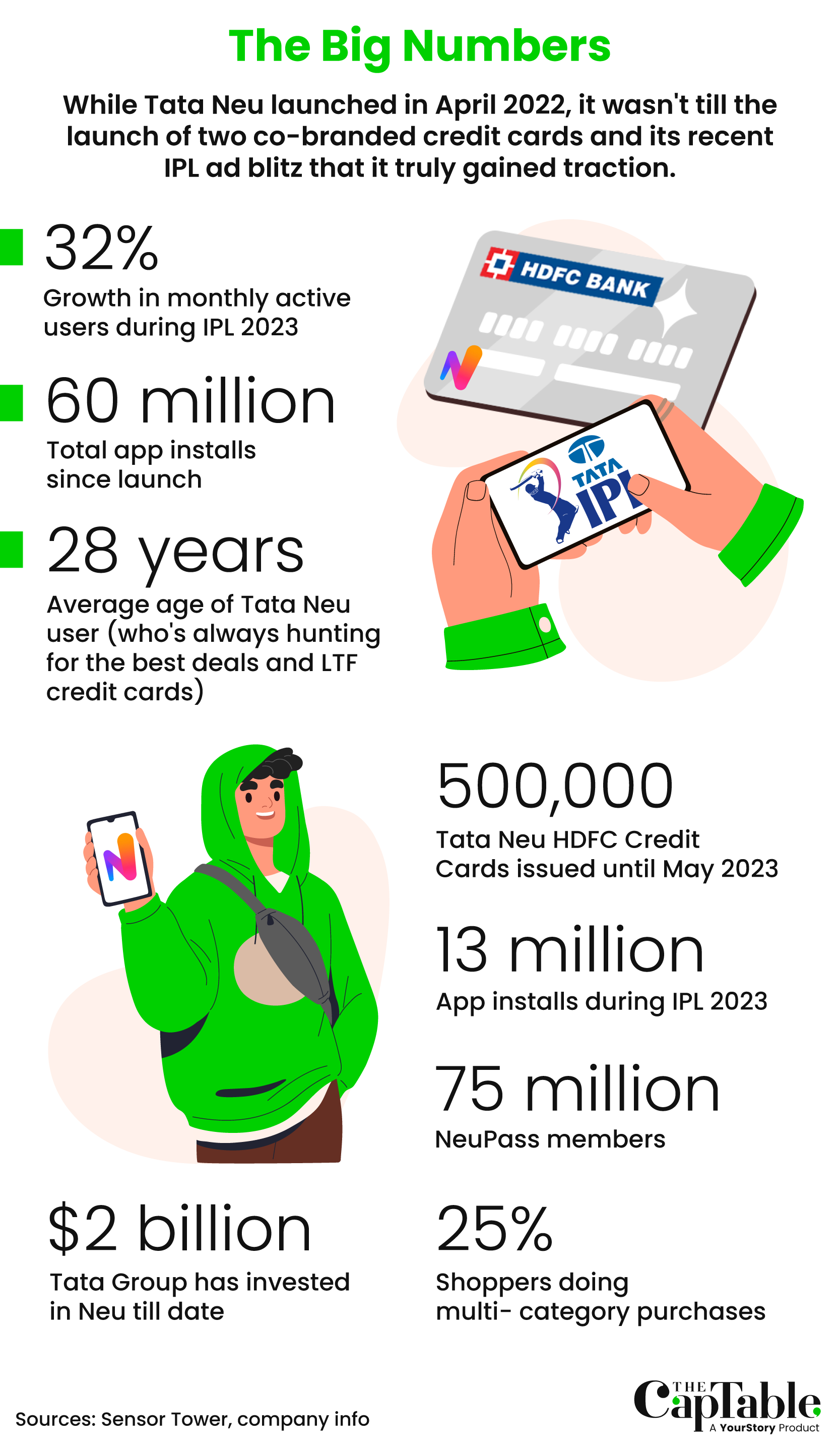

- Tata Neu recorded a 32% spike in monthly active users since the start of the cricket season in April 2023

- It has issued over 500,000 co-branded credit cards with HDFC Bank, which has been instrumental in this uptick

- Tata Digital believes its super app already services 50% of consumers' daily needs. Mobility services and embedded finance products will soon be added to Tata Neu, according to people in the know

- 75 million users have signed up for Tata Neu’s membership programme (NeuPass), which consolidates all of Tata brands’ loyalty programmes

When Tata Neu launched in April 2022, it hoped to herald a new dawn on two fronts. First, a digital coming of age for the 154-year-old Tata Group’s consumer-facing brands. And perhaps, more ambitiously, the advent of India’s first super app—something Indian startups have long contemplated but never quite pulled off.

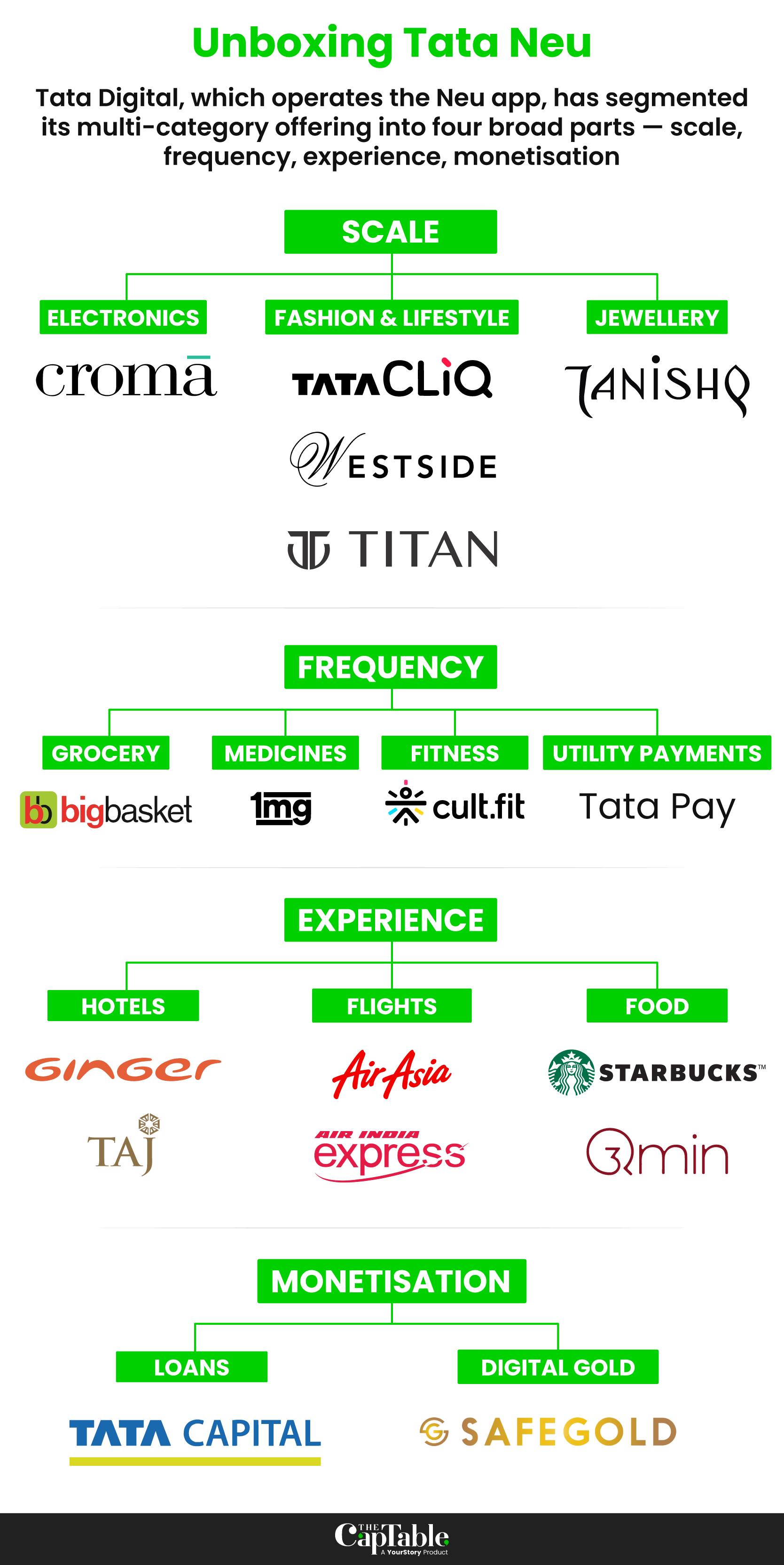

Tata was quietly confident about Neu’s chances, having tested the app privately among its employees before the public rollout. At launch, the app offered a handful of Tata brands: online grocer BigBasket, electronics retailer Croma, fashion commerce platform Tata CliQ, e-pharmacy 1MG, coffee chain Starbucks, and the conglomerate’s budget airline AirAsia. Users could sign up for a free NeuPass (Tata Neu’s in-app membership programme) and earn NeuCoins (loyalty points valued at Rs 1 each) on every purchase.

The initial signs were promising. Neu recorded 2.2 million sign-ups in its first week, and the app even trended on Twitter. All the buzz, however, quickly turned to criticism. App crashes, failed transactions, backend glitches, and a confusing rewards mechanism led to mounting consumer disappointment. Perhaps burdened by the weight of its own promises, Tata Neu failed to take flight.

Indeed, data from app intelligence firm Sensor Tower, sourced exclusively by The CapTable, indicates that Tata Neu had seen a 60% drop in users a year on from its launch. In the same period, its e-commerce rivals all boasted positive growth—Amazon India (+9% ), Flipkart (+22%) and JioMart (+25%).

April 2023, however, would mark a turning point for the beleaguered super app. Tata Neu’s aggressive advertising during the 16th edition of the Indian Premier League (IPL) paid rich dividends.

THE UPSHOT

At the start of IPL 2023, Tata Neu saw a 32% month-on-month jump in monthly active users, according to Sensor Tower data. And over the course of the two-month-long league, Neu racked up 13 million app installs, crossing 60 million lifetime installs.

Unlike the confusion surrounding the original iteration of the app, 75 million users have embraced its NeuPass membership programme so far, with an uptick in the usage of NeuCoins as well. Besides Tata Neu’s metrics trending upwards, the platform also gained tremendously from the buzz created by online deal-hunters on social media and Telegram groups, who participated in the app’s gamified rewards ‘league’ that mirrored IPL’s various stages.

A Tata Neu spokesperson told The CapTable that the Group had successfully leveraged its omni-channel presence to build euphoria around Neu during IPL. Their 360-degree campaign reached 110 million people on TV, digital, and in-stadia, with Tata Neu emerging as the second-most recalled brand during the league, per Hansa Research’s ‘IPLomania 2023’ report.

But while the IPL was a catalyst for Tata Neu’s resurgence, the needle did not move overnight.

Inside the turnaround

Vineeth K, an early adopter of the app, recounts that the initial experience wasn’t good. Neu’s relaunch three months later, though, was far better. “They had fixed the bugs, and the UI integration was almost seamless,” shares the 34-year-old data science professional. Since then, it’s only gotten better and “there’s been a complete transformation,” he says. Navigating the app is more intuitive, payments are faster, and there are way more services and rewards on the app now.

This improvement entailed several months of toil, with 50-60% of Tata Neu’s 1,000-strong workforce tasked with solving tech and product problems, says a person in the know. Even though a lot of customer complaints stemmed from individual use cases, Tata Neu could resolve “most of the crash points” that had gotten negative feedback, the person reveals.

All told, Neu incorporated over 20,000 points of customer feedback, changed processes and personnel, introduced new product offerings, incorporated more Tata services, improved its backend integrations, and went through multiple app iterations to reach where it is today. The Tata Group also pumped in more money ($2 billion to date) in Neu, according to media reports.

Infographics: Winona Lasiram

By March-April 2023, as the IPL kicked off, the Tatas were ready with an all-new version of the app. Tata Neu 3.0, as they called it, not only had more brands and offerings (Tanishq, Titan, Ginger Hotels, Qmin, Air India Express, etc.) from the Tata universe, but it also amped up the rewards and benefits for consumers, urging them to transact more during the tournament.

“We spent the last 8-odd months fixing gaps in terms of [app] experience and looked at making it best-in-class. All our app parameters are currently at par with industry benchmarks,” the Tata Neu spokesperson told The CapTable. “We also expanded our consumer offerings during this time. That helped us get the outcomes [75 million total visits on Neu during IPL] we did.”

While Tata Digital remains tight-lipped about the number of transactions or active users or sales generated on Neu so far, it is clear that the Group’s aggressive marketing during the IPL has borne fruit. “The IPL has been a terrific eyeball-gathering moment for them, where they could get millions of viewers to, at least, be aware that Tata Neu exists,” veteran brand strategist and consultant Harish Bijoor tells The CapTable. “But awareness alone isn’t enough. It has to convert into interest and usage of the app.”

That utility is something Tata Digital thinks Neu has in spades. It believes that Neu already serves 50% of the average customer’s daily, monthly, and annual needs—from grocery/medicine shopping and fashion, to food, travel, and utility payments.

According to the company’s spokesperson, over 25% of Neu users are already doing multi-category transactions, validating the Group’s super app ambitions. And now, the company is actively working on filling some “vital gaps” such as mobility, financial services (beyond loans), equity investments, etc, in Neu, as per people in the know.

“What we have right now is [from] within the Tata ecosystem. We will look at widening consumer choices. But if an app already takes care of 50% of consumer needs, we’re making inroads,” adds the spokesperson.

Super app model

Constructing a super app, though, is no cakewalk. Especially, when you’re servicing a population as diverse as India’s. In China, for instance, the most successful super apps have been built on top of one core proposition—messaging when it comes to WeChat (1.2 billion MAUs), and payments in the case of AliPay (681 million MAUs). Even in Southeast Asia, Grab and GoJek built their super apps on the primary offering of ride-hailing, and later expanded into other areas from food delivery and grocery to logistics and financial services. Tata Neu, however, is yet to arrive at that singular draw.

“Tata Neu is meant to be a super app because it fundamentally deals with ‘n’ number of offerings. But all the loyalty programmes that are running on Tata’s other brands, from Taj to Westside, have to be fully subsumed within NeuPass. That hasn’t happened yet,” explains Bijoor, who has crafted strategies for many consumer internet brands. “Plus, super-apps cannot be only about yourself, it has to be about others (third-party brands and services) too,” he adds.

For internal purposes, Tata Digital has segregated its offerings under Neu into four, broad, goal-oriented buckets—scale, frequency, experience, and monetisation. The segregation also helps them drive better user growth and revenue realisation for each offering on the app. “Each one has a role to play. And all the brands have witnessed encouraging results in terms of their GMV contribution to Tata Neu [overall],” shares the spokesperson.

Infographics: Winona Lasiram

Simultaneously, Tata’s offline-first brands such as Croma, Westside, Titan, and Tanishq have also been able to acquire new customers through the Neu channel. So, the cross-selling benefits have started to kick in. “It has worked both ways, one feeds off the other,” says the Neu spokesperson.

In the first 2-3 weeks of IPL, as consumers started warming up to Tata Neu’s gamified rewards mechanism, luxury buying on the platform took off massively. “About 7-8 Cartier watches were sold in the first few weeks of IPL, of which 30-40% were done on the Tata CliQ app and the rest happened on Neu. The whole NeuCoins thing was finally hitting home,” a person aware of the developments told The CapTable.

Tata Digital expects the “flywheel of NeuCoins” to be a major growth driver in the months to come. Besides fulfilling their functional needs like groceries and fashion, consumers can now book a flight on Air India, a hotel stay on Taj or Ginger, and if it’s an expensive holiday, they can even avail a loan from Tata Capital—all without exiting the app, thereby creating an endless consumption loop. “It is too compelling for the consumer to not want it,” says the person quoted above.

But, unlike India’s other consumer-facing startups, Tata Digital is “in no hurry” to chase vanity metrics like TAM, DAUs and MAUs. “Neu is trying to build utility for the customer, it cannot function at a high decibel all year,” adds the spokesperson.

‘Credit’ where it’s due

Besides the growing allure of NeuCoins, Tata Neu’s co-branded credit card with HDFC Bank has been another crowd-puller. It has steadily gathered steam since its wider rollout in November 2022, with credit card aficionados taking to social media to educate users about its benefits and rewards. Its popularity peaked once the RuPay version of the card was introduced earlier this year.

Between November and now, over 500,000 Tata Neu HDFC Bank Credit Cards have been issued, The CapTable has learnt. This is a record among co-branded credit cards (Flipkart-Axis, Amazon-ICICI, Paytm-SBI, EazyDiner-IndusInd, etc.) in the market. “We are the fastest to achieve this milestone among such cards,” the Tata Neu spokesperson confirms. “Customers are very excited about linking their RuPay credit cards to UPI for merchant payments.”

The lifetime free (LTF) card, which consumers—many of them new to credit—are relishing, is not only bringing repeat users to Tata Neu, but is also causing behavioural shifts, with more and more users now automating their bill payments via Tata Pay. Tata Neu also gives them a ledger view of their monthly bills, along with the option of paying all of them together.

Beyond the utility factor, users get to enjoy additional rewards with the co-branded credit card. While Neu users typically get 5% of their purchase amount back as NeuCoins, it is bumped up to 7-10% if they transact with the Tata Neu HDFC Bank Credit Card. “It’s a win-win for consumers who plan to stick to a certain platform for a long time,” adds Vineeth, who’s also a credit card geek and runs a social media community on it.

In May, during the IPL, he spent upwards of Rs 15,000 across nine different transactions on the Tata Neu app, and earned scores of rewards and vouchers. “In any middle-class family, monthly groceries and medicines would cost you that amount. The user interface is seamless now, and I’m even open to booking flights and hotels if other [non-Tata] brands open up on the platform,” he says.

Then there’s Girish Mallya, a 48-year-old media professional and veteran credit card user, who frequently loads his Starbucks card and makes utility payments using the Tata Neu HDFC RuPay Credit Card. “It is slowly incentivising me to use Neu more and more,” he shares. “And for a 20-25-year-old, who is UPI-savvy and looking to get his first credit card, it’s an easy sell. This co-branded card could actually replace the Amazon-ICICIs and Axis-Flipkarts of the world, which have already been milked,” he explains.

Additionally, the Indian government’s Rs 1,300-crore plan to boost usage of homegrown RuPay cards by incentivising banks to issue more of them in order to challenge the Visa-Mastercard duopoly is the icing on the cake for Neu. Banks, in turn, are urging their customers to use RuPay cards for even low-value digital transactions as they stand to earn a percentage of these amounts from the government. “The initial response to the Tata Neu-HDFC card [both the Plus and Infinity variants] has been very good, and we will look at growing the benefits on the card,” the Tata Neu spokesperson states.

Competitive landscape

E-commerce observers say that the world of super apps isn’t a clearly defined one. Even Amazon could technically be classified as a super app since it lets you shop for groceries, fashion, electronics, and medicines, book flights and movie tickets, make bill payments, watch shows (miniTV), and even avail instant loans to fund all your purchases.

“Just because you are a conglomerate and you are present in multiple businesses… That can’t be the reason to have a super app. Anybody can be a super app... Tata, Reliance, even ONDC,” says Mohit Rana, Partner at Redseer Strategy Consultants.

Despite this, says Rana, India is yet to see a super app success story even though it is a predominantly mobile-first market. “It is clearly a bet that people are taking on the fact that they will be able to change user behaviour.”

What could play into Neu’s hands, however, is the new generation (Gen Z and Gen Alpha) of consumers becoming the most dominant users of digital services. These users are not averse to the cluttered nature of super apps, which could mean that the time has finally arrived for such an app in India.

Abe Yousef, senior insights analyst at Sensor Tower, tells The CapTable, “The effectiveness of such offerings tends to diminish in markets outside of China. This is primarily due to the presence of a larger number of competitive players in each service provided in most markets. So, establishing consumer loyalty in this context can be a costly endeavour, and unless a super app is committed to continuously investing in aggressive user acquisition promotions, sustaining consumer engagement and traffic becomes unpredictable.”

Ask the Tata Group about competition, and they will tell you that “there’s space for everyone to exist” because there’s no real textbook definition of a super app. “As a consumer, we are spoiled for choices. It’s the experience that matters. With NeuCoins and NeuPass, we have all the propositions to build customer loyalty,” says the spokesperson.

Sector observers say India is potentially gearing up for 4-5 super apps, with conglomerates such as Reliance Industries and Adani Group having announced similar ambitions. Reliance, in particular, has offline distribution and deep pockets to rival the Tata Group. Then there’s government-backed ONDC (which could turn into a super aggregator of apps) and also the likes of fintech-first startups such as Paytm and PhonePe that want to be one-stop-shops for their users.

“Tata and Reliance, of course, have the financial and regulatory muscle. But you can’t have a super app with totally disparate things. There has to be some consistency in the offerings,” says Redseer’s Rana.

At the same time, for a super app to be truly successful, it cannot remain a walled garden either. Hence, the expansion of the Neu ecosystem by including both international and domestic consumer brands, especially those beyond the Tata stable, is very much on the table. But it will happen only after all the Group’s own brands have been consolidated.

Until then, says Bijoor, people would remain hungry to get the best of all services.

Edited by Ranjan Crasta

LatestStories

Mobility

Premium Reads

CEO exit highlights Ola’s mounting ride-hailing struggles

By Pranav Balakrishnan

Media Entertainment

Premium Reads

How Pocket FM won over Middle America to hit $160 Mn in ARR

By Sohini Mitter

Fintech

Premium Reads

The case for New Umbrella Entities to counter UPI’s foreign-owned duopoly

By Dr Srinath Sridharan

For subscribers only

Deeply reported and objective news on the country´s fastest-growing companies and the people behind them.

11 Min Read

CEO exit highlights Ola’s mounting ride-hailing struggles

By Pranav Balakrishnan

9 Min Read

How Pocket FM won over Middle America to hit $160 Mn in ARR

By Sohini Mitter

8 Min Read

The case for New Umbrella Entities to counter UPI’s foreign-owned duopoly

By Dr Srinath Sridharan

10 Min Read

Protect fliers or airlines? India’s dilemma as airfares to Singapore, Gulf soar

By Raghav Mahobe

11 Min Read

Will RBI’s new directive spell trouble for India’s booming creator economy, small businesses?

By Nikhil Patwardhan

4 Min Read

Reliance brings telecom's predatory pricing to OTT; will JioCinema's latest plans harm Netflix, Amazon?

By Sohini Mitter