Key Takeaways

“India is at the cusp of the next payments revolution where credit will become the mainstream payment choice,” declared Vijay Shekhar Sharma during the launch of Paytm’s new co-branded credit card—issued in partnership with SBI—in May 2023.

While credit cards aren’t new, only about 3% of India’s population owns them—well below the World Bank’s benchmark of 30%. Traditionally, Indians have had a fear-based relationship with credit cards, largely viewing them as debt traps. “Most of India's first credit card users were expatriates familiar with how credit card systems worked. This resulted in a misconception that credit cards are a luxurious foreign consumer product reserved for the extremely wealthy,” reads a 2022 note from Kotak Mahindra Bank.

But the times, they are a-changin’.

Today, there’s far greater awareness and far lesser trepidation around credit cards. Indians are slowly yet surely realising that credit cards can also become a tool for financial access, rewards, and benefits.

While the seasoned credit card users in urban India are stacking up more cards and optimising spends across categories, the younger, digitally-savvy, and ‘new-to-credit’ users are beginning their credit journey with co-branded cards (which are jointly issued by banks and merchant platforms).

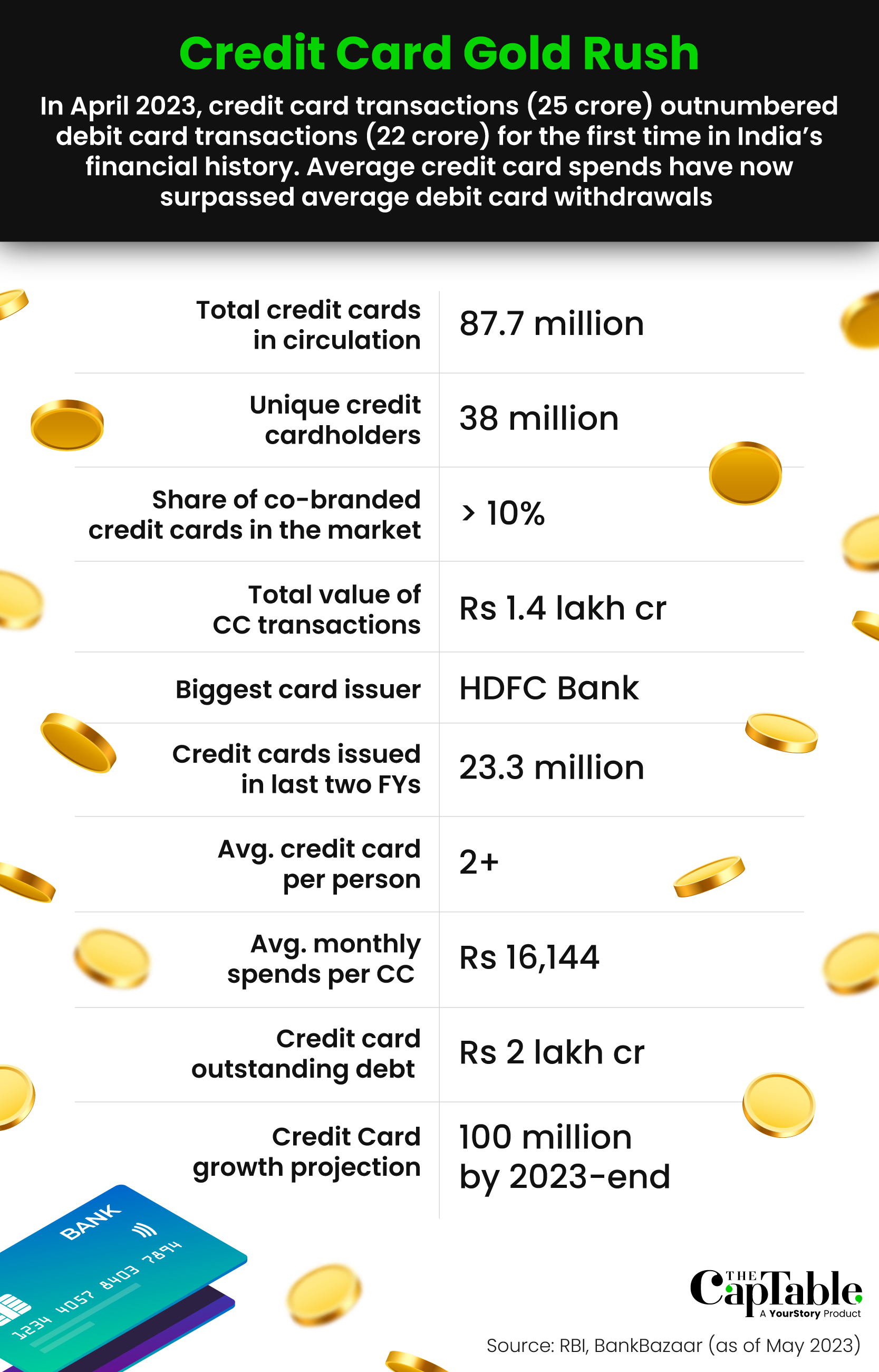

Both ends of the spectrum have heralded a new dawn for credit adoption in the post-pandemic years, with credit card circulation growing from 50 million in 2020 to 87 million in 2023, according to the Reserve Bank of India (RBI).

Take Sudhan D, for instance. The 43-year-old finance professional from Mumbai owns more than 30 active credit cards. There’s a ‘hero card’ in HDFC Infinia, with 50% of his monthly spends directed towards it. Then there are the mid-to-premium pure-play cards issued by multiple banks. And then come the co-branded cards—Axis-Vistara (for air miles), HSBC-MakeMyTrip (for travel), HPCL-Bank of Baroda (for fuel), Flipkart-Axis and ICICI-Amazon (for shopping), and the red-hot Tata Neu-HDFC RuPay credit card (for daily spends via UPI).

With a different card for each category of spends, Sudhan is what you’d call a credit card geek (#CCGeek)—the kind that have infiltrated Twitter (now X), Reddit, and Telegram. “Every single spend of mine has been converted to an online spend now. I make it a point that every rupee I spend is through a credit card,” he tells The CapTable, adding, “I use a debit card only if there is a specific discount on it and for ATM withdrawals.”

Sudhan’s spending pattern is reflective of a larger trend that’s playing out in the country.

Additionally, outstanding credit card debt also crossed Rs 2,00,000 crore for the first time, amounting to 30% yearly growth.

Much of India’s newfound affinity for credit cards has been a result of banks cosying up to online merchants, e-commerce platforms and new-age fintechs to launch more and more co-branded cards to lend to the country’s largely underserved customer base.

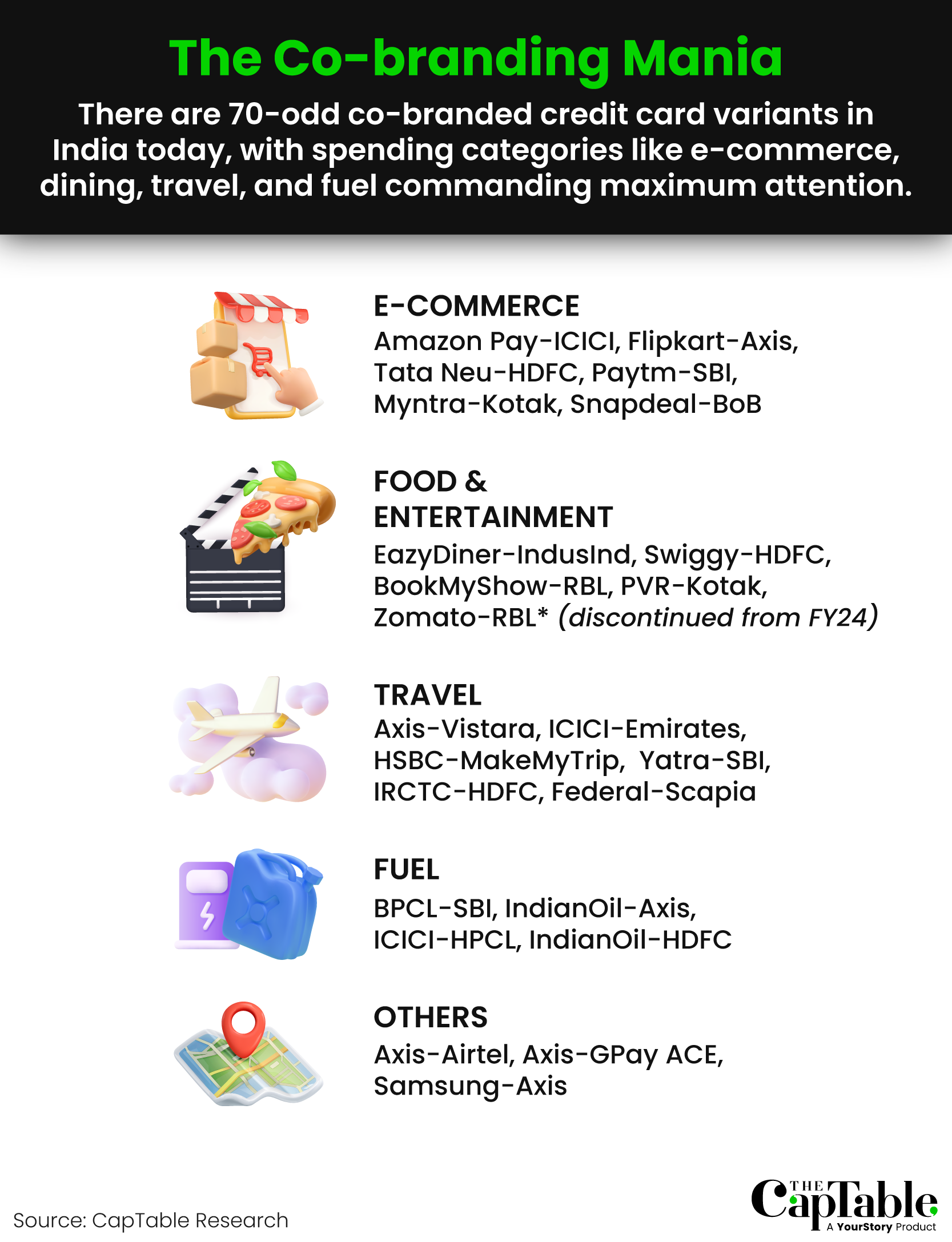

Industry estimates suggest that 1 in 3 new credit cards issued today are of the co-branded variety. Currently, there are 70-odd variants of co-branded cards in the market, accounting for 10-12% of the total credit cards in circulation. Most popular are the shopping, dining, travel, and fuel cards, with scores of first-time users lapping these up.

For 20-something media professional Akanksha S, the Flipkart-Axis Bank co-branded card was her introduction to the world of formal credit. She’s owned it for a month, with card spends now touching ~Rs 30,000. “I was intrigued by the proposition of saving a lot on e-commerce platforms. Also, I had heard from friends that this was an easy card to get, and that was largely the draw,” she tells The CapTable.

While she hopes to get a general/pure-play credit card in the near future, Akanksha is trying to build her credit score with the Flipkart-Axis card. “Building a credit score is very important to me as I don't have one. The co-branded cards are an easy way to get it quickly. Plus, the easy onboarding helps,” she says.

Infographics: Winona Laisram

Besides the quick application process, mostly via the merchant app or website, and the paperless onboarding, co-branded credit cards are also gaining in popularity due to low entry barriers. Most cards are either offered lifetime free (LTF) or have nominal joining and annual fees (~Rs 500) that are more palatable to new users. This is where the likes of the Amazon Pay-ICICI card and the Flipkart-Axis card have scored highly. Both products have been bestsellers since launching in 2018-19, and now account for more than 30-35% of their respective bank’s overall credit card portfolio.

Adhil Shetty, Co-founder and CEO of BankBazaar, tells The CapTable,

“There are 3.8 crore unique credit cardholders in India, which comes at 1-2 cards per person. So, the co-branded cards are actually building the market. Indian banks have been very agile on this front. And now everyone is seeing an opportunity here. This 3.8-crore user base can double in the next 3-5 years.”

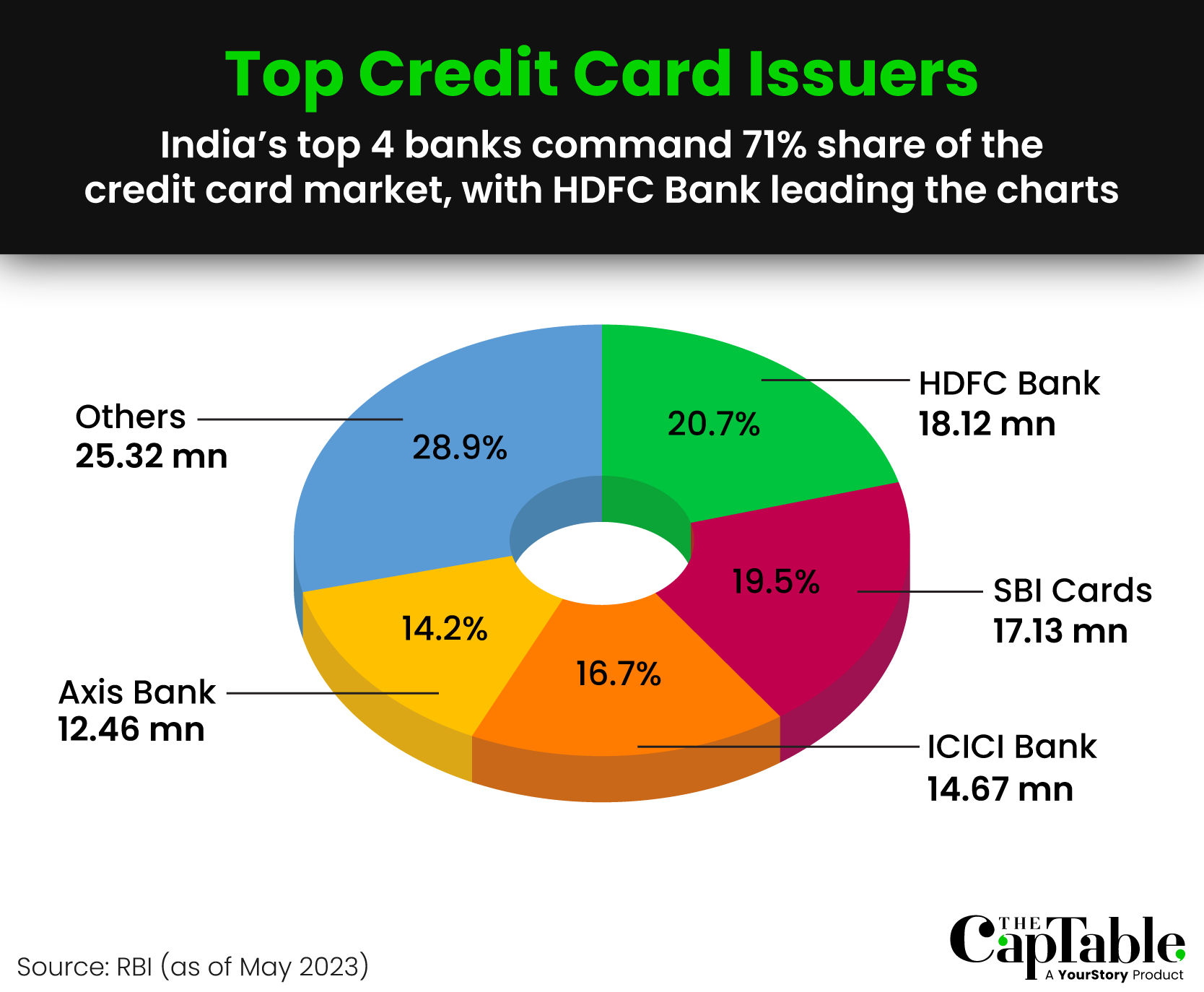

The country’s top four banks—HDFC, SBI, ICICI and Axis— control 71% of the domestic credit card market in terms of circulation. Each of these banks has issued over 10 million cards, with HDFC poised to surpass the 20-million mark by the end of 2023. One of its most successful co-branded partnerships has been with super app hopeful Tata Neu. Not only did the card breathe new life into the ailing app, but it also made HDFC the first bank to process UPI transactions worth Rs 500 crore on RuPay cards, as per a July 2023 bulletin by the National Payments Council of India (NPCI).

Between November 2022 and June 2023, over 500,000 Tata Neu-HDFC Bank credit cards were issued—a record in the co-branded card segment. “We were the fastest to achieve this milestone among such cards,” a Tata Neu spokesperson told The CapTable, exclusively. “Customers are very excited about linking their RuPay credit cards to UPI for merchant payments.”

While UPI linking is restricted to RuPay cards for now, BankBazaar’s Shetty reckons that India’s credit card spends will skyrocket if that option is extended to Mastercard and Visa cards, too. “That will grow the merchant-side opportunity from 6 million to 60 million in one fell swoop. Spends will go up 20% with just this linkage,” he says.

Market watchers further believe that the currently ‘hot’ Tata Neu-HDFC RuPay credit card also has the potential to be the next Amazon Pay-ICICI credit card. With nearly 4 million cards issued so far, the latter has been a runaway success in the co-branded card space, closely followed by the Flipkart-Axis credit card which has clocked 3.5 million issuances. Combined, they account for ~75% of India’s entire co-branded credit card market.

Sumanta Mandal, Founder of TechnoFino (a platform reviewing credit cards and other banking products), shares that shopping and lifestyle co-branded cards have had much more impact than the travel and fuel ones.

“That’s because India’s shopper base is much larger than the traveller base. And all the top e-commerce platforms today have their own co-branded cards. The upfront discounts and cashbacks are much better than rewards and points which accumulate over time,” he explains.

Co-branded credit cards can appeal greatly to those who aren’t yet eligible for premium cards like a Diner’s Black or a Magnus or an Infinia. “They can be very useful for low-ticket size and high-frequency transactions on a platform, and will find users who are looking to optimise across categories instead of routing all their spends through one card,” says Stoa School founder Raj Kunkolienkar, who is an avid credit card user.

It isn’t just users who are seeing the upside. Co-branded cards have emerged as a vital weapon in the arsenal of consumer-facing startups and their partner banks.

Amazon Pay-ICICI and Axis-Flipkart have been tremendous success stories because of the sheer volume of users the two e-commerce platforms have captured for the banks.

“Co-branded credit cards actually started 10-12 years ago with Shoppers Stop, Times, and MakeMyTrip attempting it. But distribution was a challenge then, and those cards never took off. Amazon and Flipkart solved the problem of distribution and now those cards have reached users in every city,” says Ankur Kumar, who runs Credofly, an online community of credit card users.

Contrast this with the Paytm-HDFC Bank credit card that launched in 2021. “It failed to buzz because people don’t see Paytm as an online store where they’re buying something continuously. They use it mostly for payments,” Kumar states.

Earlier in 2023, Paytm went on to extend its partnership with SBI Cards to launch a RuPay credit card with UPI linkage. Almost immediately, this boosted the company’s visibility in the co-branded segment.

“Our co-branded credit cards business has scaled very well, and we have 7.5 lakh activated cards [now],” Paytm CFO Madhur Deora revealed during the company’s earnings call for the quarter ended June 2023.

Infographics: Winona Laisram

The EazyDiner-IndusInd Bank credit card is another success story. Designed to reward those who dine out frequently, the card has been touted as one of the best in the co-branded segment. “We’ve seen those who own the card dining out much more per month,” an EazyDiner spokesperson told The CapTable.

It’s evident that merchant platforms are using co-branded cards as a mechanism to build customer stickiness, improve app engagement, increase transactions and GMV, and reward loyal consumers with cashbacks and discounts.

Banks, too, are seeing tremendous upside.

Typically, banks end up spending Rs 2,000-2,500 to acquire one credit card customer through the traditional push-marketing and feet-on-street channels. But when it comes to co-branded partnerships with online platforms, they get ready access to a captive user base that runs into hundreds of millions. As a result, their customer acquisition cost (CAC) drops to near-zero.

BFSI watchers told The CapTable that the uber-successful Amazon Pay-ICICI card brought the bank 2 million new customers, while 75% of those who availed the Flipkart-Axis card were new to Axis Bank.

“ICICI Bank’s reach in Tier 3-4 cities was very limited. But even those who don’t have ICICI accounts use Amazon for shopping, and that helped the bank gain a whole new set of customers,” says a person aware of the development.

Co-branded credit cards also enjoy high activation rates of over 70%, according to industry estimates. “When bank agents hard-sell a card to a customer, they often don't end up activating it. But when a user applies for a card directly, the activation rate is very high, and they start transacting immediately. It’s the push-versus-pull factor,” explains Kumar of Credofly.

BankBazaar’s Shetty believes these cards are growing from a financial access standpoint too. “Banks get a brand new target segment which they can lend to, which is the primary reason why they are getting excited about co-branded partnerships,” he says. “These potential customers are in the 30-to-40-year-old age group from the mass affluent segment who want to track their credit scores, take loans, and improve their personal finance portfolio.”

Not every credit card user is looking to optimise and maximise, though. A simple cashback of 5% is often “a killer proposition” for most, especially first-time users, Shetty adds.

Banks are also incentivised by card networks like Visa and Mastercard to sell more credit cards. Co-branded partnerships often become a means for them to complete their own card issuance milestones. “Even the card networks themselves earn a fraction of the fee. That’s also an incentive for them to push credit card adoption,” according to ex-banker Arvind Datta.

“Earlier, banks saw credit cards as a risky, unsecured business. But no bank ever loses money on the credit cards business. They earn a hefty interest income from revolvers (those who carry their balance to the next month). Then there are joining fees, annual fees, late payment fees, interchange fees, etc,” shares Datta, who formerly led credit products at HDFC Bank, Citi India, and UAE’s First Abu Dhabi Bank.

Infographics: Winona Laisram

For all these gains, the country’s credit card penetration of 3% is still woefully inadequate. Especially, when compared to USA’s 66%, UK’s 65%, and Brazil’s 30%. But India’s formal journey of credit adoption has only just begun.

Before the pandemic, credit cards recorded more offline swipes than online. However, the trend reversed between 2020 and 2023. Today, credit card spends on e-commerce platforms are 76% higher than via offline points-of-sale, according to the RBI. Besides shopping and travel, credit cards are also being routinely used for rent, educational payments, and utility bills.

Datta, who now runs a wealth management firm called Marigold Wealth, says, “Credit cards have now become watercooler conversation. There’s so much awareness floating in the ecosystem today about reward points, lounge access, free tickets, memberships, and so on. All this excites young people and urges them to get more cards.”

TechnoFino’s Mandal, who gets thousands of credit card queries on his platform every month, concurs.

“In the US, every retailer from Walmart to Cotsco to Macy’s has a co-branded credit card. They call it a ‘store card’. That trend will come to India in another 5-6 years. Credit cards have already put the brakes on debit card usage in India,” he states.

Several bankers and #CCGeeks are now looking forward to the potential launch of a Jio co-branded credit card. However, there’s no indication of it thus far. But it’s looking like an inevitability, reckons Datta, now that Reliance has spun off Jio Financial Services as a separate subsidiary.

“With KV Kamath (former MD and CEO of ICICI Bank) leading the Jio Financial vertical, ICICI Bank might have an edge in bagging that relationship,” he says.

Elaborating further on the appeal of such a credit card, Datta says, “Jio has 40 crore telecom subscribers and a similar number of customers across RIL’s retail outlets. It's a goldmine for any bank… to have that kind of a cross-sell opportunity. They can even do a Jio business credit card given Reliance’s existing partnership with WhatsApp and JustDial.”

It’s a lot of conjecture, sure. But there’s no doubt that India is perched on the cusp of a credit card boom—just the sort of thing Reliance would love to get a piece of.

Edited by Ranjan Crasta

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now