When Urban Company announced its annual results on Wednesday, the focus was understandably on India’s largest home-services platform achieving profitability.

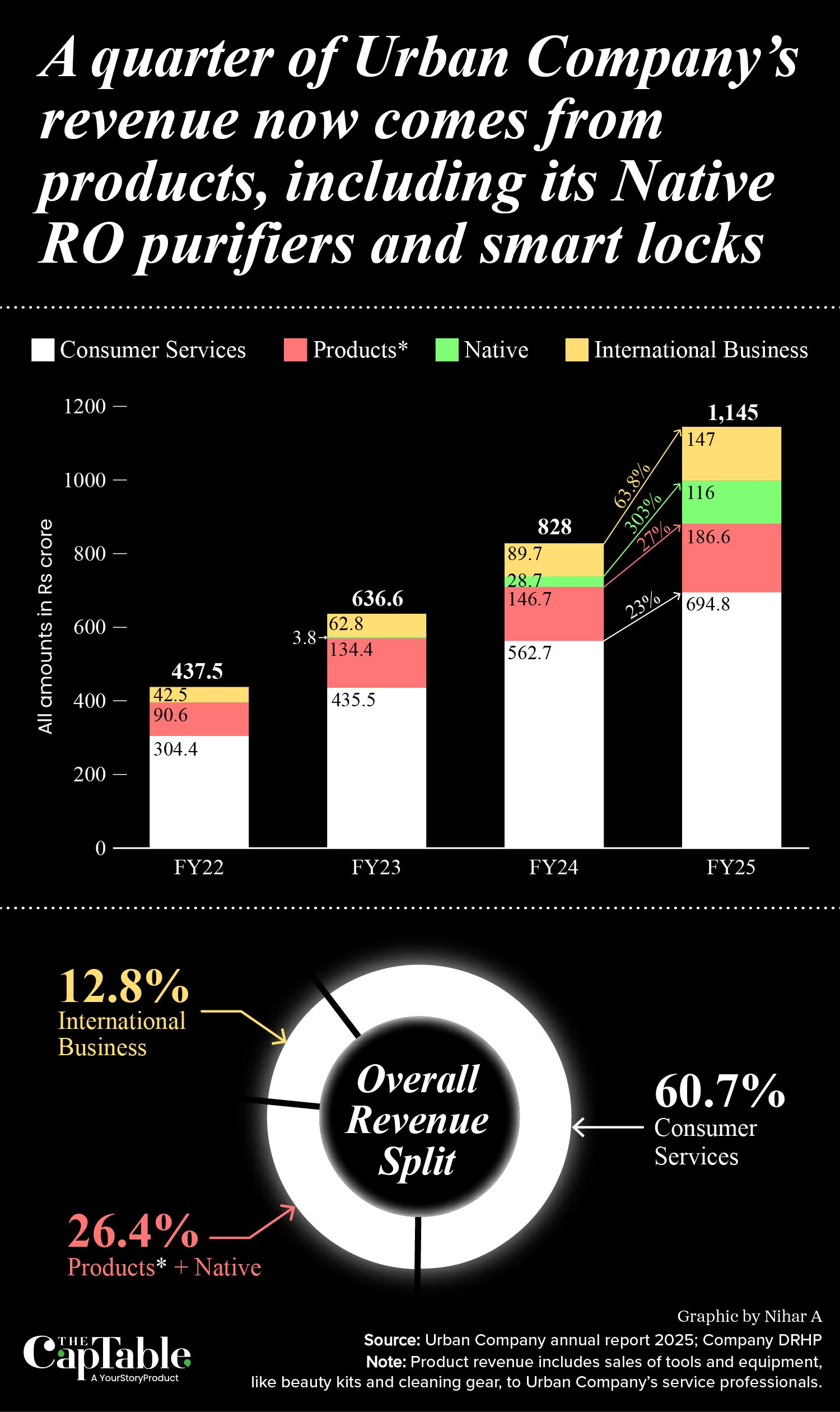

The startup reported a Rs 240 crore profit in fiscal 2025, reversing the previous year’s Rs 93 crore loss, with revenues growing 38% to Rs 1,145 crore.

Yet a closer look into the figures reveals something equally impressive. Product sales accounted for over Rs 300 crore, representing about 26% of the total.

Urban Company, known mainly for sending beauticians, plumbers, and cleaners to your doorstep, has clearly evolved far beyond its original model of connecting customers with service providers.

The shift comes at the right time. India’s home services industry presents a significant opportunity, with a total addressable market of Rs 4,990-5,070 billion in 2024, projected to grow at 10-11% annually to Rs 8,220-8,350 billion by 2029, according to a Redseer report.

But Urban Company’s transformation could make the opportunity even bigger.

The first is Native, Urban Company’s consumer electronics brand launched in 2023. This division posted Rs 116 crore in revenue during FY25, a remarkable 303% increase from the previous year’s Rs 28.7 crore.

Native focuses on water purifiers and smart locks, addressing specific consumer pain points. Water purifiers typically require servicing every six to 12 months, creating ongoing costs and inconvenience for users.

Urban Company identified this opportunity through its service operations, handling between 45,000 and 50,000 water purifier maintenance requests monthly.

“We understood the consumer pain point of regular servicing of RO purifiers, given that they rank among appliances needing more maintenance expenses than purchase,” Aayush Agarwal, Vice President of the Native vertical, was quoted as saying by The Ken.

Native’s water purifiers don’t need servicing or filter replacements for up to two years. The company works with manufacturing partners in India for purifiers and sources smart locks from China.

“We believe that these Native products drive a higher level of consumer engagement on the Urban Company consumer application, which can in turn benefit other categories over time,” the company noted in its DRHP.

The second revenue stream operates behind the scenes: equipment and supplies sold to Urban Company’s workforce, including beauty kits, repair tools, and cleaning gear. This generated Rs 187 crore in FY25, growing 27% year-on-year.

Urban Company’s annual filings describe these as “tools and consumables” that service professionals “can choose to buy from us, for use during their service delivery”.

But Urban Company gig workers claim that they are required to purchase these items regularly through the platform.

Each product comes with a barcode that must be scanned before beginning a job. The professionals claim that if they use products from outside the Urban Company ecosystem, the app won’t allow them to proceed.

A cleaning professional working in Delhi NCR explained the financial impact: “I spend anywhere between Rs 3,000 and Rs 4,000 per month.”

A former salon partner who now works with competitor Yes Madam described her experience: “The products usually lasted a month or more. It depends on the number of jobs you do.” She typically spent Rs 10,000 per purchase while working in Urban Company’s classic salon category.

Multiple service providers across different categories confirmed that they are expected to buy the startup’s products. Urban Company declined to comment for this story.

This dual-product approach has several advantages. It generates higher profit margins compared to service transaction fees while reducing dependence on commission-based revenue models.

The strategy also creates predictable income streams. Consumer appliances through Native build brand loyalty and repeat engagement, while purchases by the workforce provide consistent monthly revenues.

However, the approach carries risks. Kent RO filed a patent infringement lawsuit against Urban Company in September 2024, challenging the Native water purifier business. The case is pending in Delhi High Court, with Kent seeking a permanent injunction to stop manufacturing and sales.

Urban Company has disputed these claims and filed counterclaims. It also initiated separate legal action against Kent, alleging the dissemination of false information through online retail platforms.

Urban Company’s product revenues represent more than diversification. They demonstrate a fundamental business model evolution from pure marketplace facilitation to integrated retail operations.

The product segment now provides substantial revenue stability while the startup prepares for its IPO. This positions Urban Company as more than a service aggregator. It’s become a comprehensive platform that monetises multiple touchpoints across its ecosystem.

Edited by Jarshad NK

Got a tip? If you have a lead we should be chasing at The CapTable, write to us at [email protected]

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now