Key Takeaways

In late October, credit card forums were abuzz with rumours of Reliance Industries Ltd launching a co-branded card in partnership with India’s largest lender, SBI. Soon, card prototypes started doing the rounds on social media and Telegram channels. Reliance entering the red-hot co-branded credit card space was all but an inevitability, as The CapTable reported in August. But what grabbed eyeballs was the fact that it opted for India’s indigenous card network RuPay for the partnership.

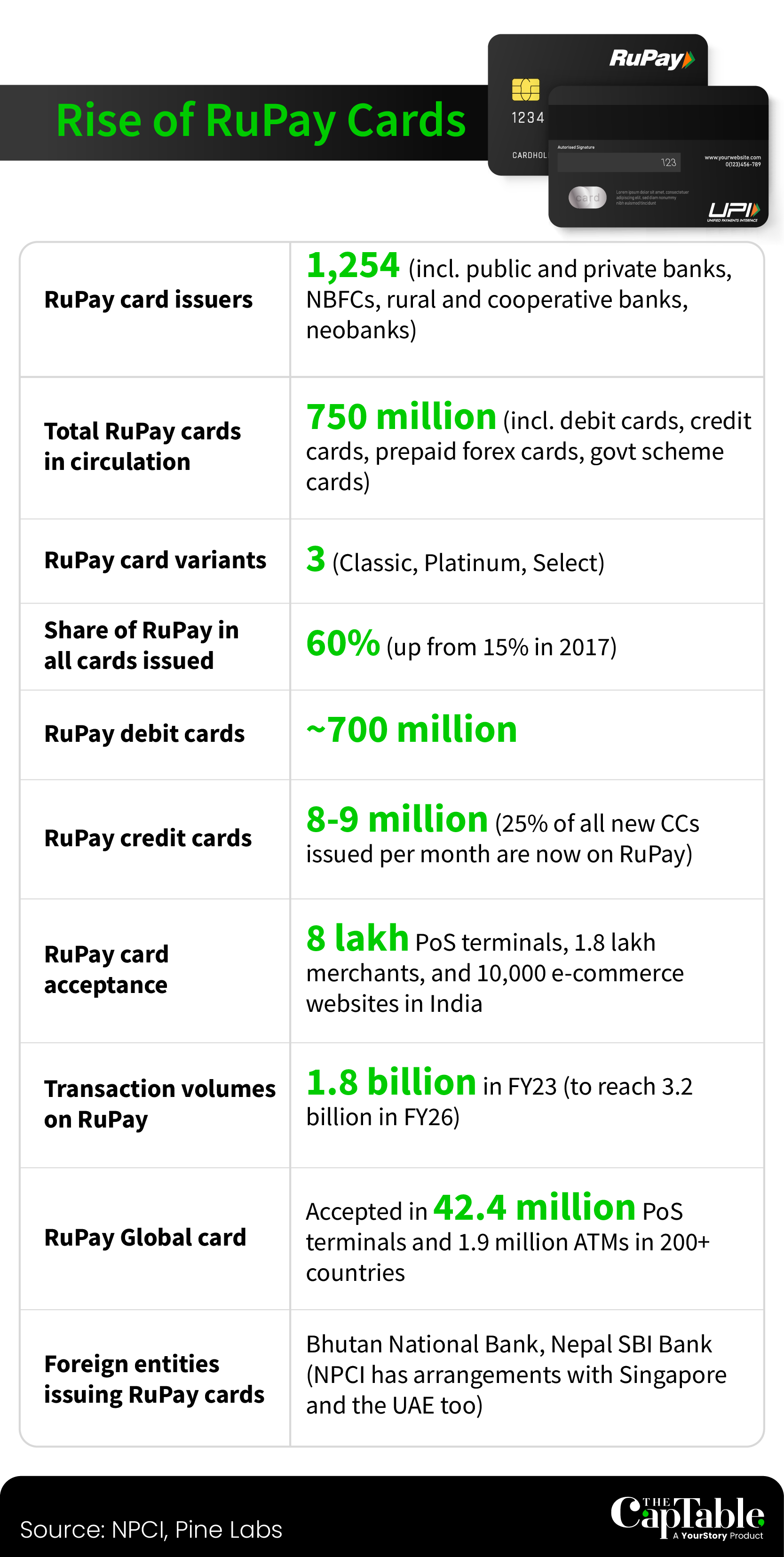

This comes on the heels of RuPay’s steady rise in India’s credit card market, with the homegrown network now accounting for 25-30% of new card issuances, up from 10% a year ago, according to the National Payments Corporation of India (NPCI),

Add to that, in the July-September quarter, the demand for RuPay credit cards actually surpassed that of other cards in India’s hinterlands. A recent report by financial services distributor ZET, which has 55-odd banking partners, indicates that 37% of new cards issued to customers in 700+ smalltowns were on RuPay, with Mastercard (32%) and VISA (31%) trailing.

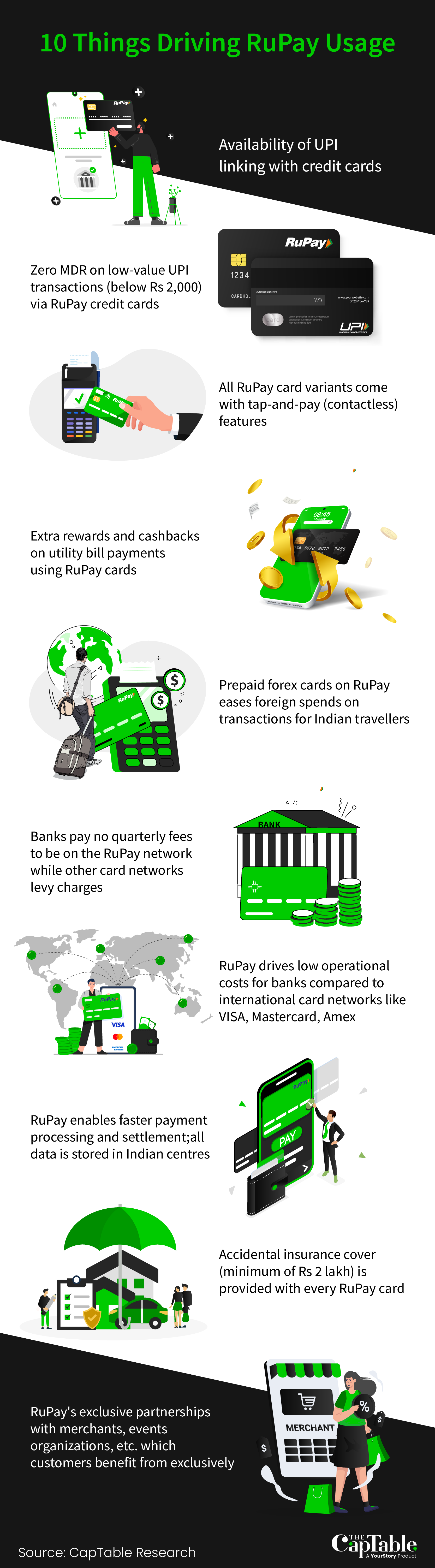

RuPay’s expanding presence in India’s dynamic credit card ecosystem is a derivative of many things, most significant of which is the RBI’s decision to allow linking of the ubiquitous UPI platform with these cards — a feature that international card networks VISA and Mastercard have been deprived of for now. Since April 2023, nearly 25 major banks and 15-odd fintechs in the country have jumped onto the UPI-linked RuPay credit card bandwagon, issuing both physical and virtual cards to cater to an increasingly financially-savvy population that not only wants the convenience of digital payments but also devours the ready access to credit and the rewards and benefits that come with it.

HDFC Bank, which was the first private sector lender to go live with the feature, has issued about 7.5 lakh UPI-linked RuPay credit cards since April, and became the first bank to process transactions worth Rs 500 crore on it. At present, it is issuing 1-2 lakh RuPay credit cards per month, and accounts for an impressive 45-50% of India’s total spends on UPI-linked RuPay cards, Parag Rao, Country Head - Payments Business, Consumer Finance, Technology & Digital Banking, HDFC Bank, told The CapTable.

“Credit is growing across geographies. Today, customers are looking at credit cards from a larger aspirational level. So, we’re seeing both spends growing as well as the demand for cards going up. There’s also a resurgence in credit card spends in categories like travel, dining out, etc. which had kind of shut down during COVID,” he says.

Infographic: Ahamed Thahir

Rao believes that India’s rapidly growing UPI user base (approx. 300 million daily transacting users) will act as a “funnel for future credit cardholders”, many of whom are starting their journey with RuPay cards. “Even if you leave out the existing 80-90 million credit card holders, that still gives you the opportunity to convert more than 200 million customers who are already on electronic payments. As ecosystems evolve, aspirations grow, and people get more conscious about credit scores and prudent fiscal behaviour, we’ll see a large portion of that [UPI] customer base coming onto credit cards,” he explains.

Even though RuPay credit cards lag VISA and Mastercard in volumes and value of transactions, there’s been a steady uptick — both in individual card spends as well as transactions per card — with banks being nudged by NPCI to issue more RuPay cards. Banks don’t mind it given they have to pay no quarterly fees to join the RuPay network and can maintain their payment systems at one-third of the cost compared to what is incurred at foreign networks.

“Spends and transactions on UPI-linked credit cards are increasing rapidly across the whole industry, which is a very positive sign for RuPay,” Adhil Shetty, CEO of fintech firm BankBazaar, tells The CapTable. “But the RBI doesn’t report this data. Anecdotally, when we speak to our partners who have launched RuPay credit cards, what we’re finding is that UPI spends on those cards—though starting from small amounts—are increasing quickly.”

A massive boost for Rupay came when the RBI decided in June 2023 to allow the issuance of RuPay prepaid forex cards for use at international ATMs, PoS terminals, and online merchants. This works well for Indian travellers who will not only have more payment choices at their disposal but will also end up spending less overseas. “The forex mark-up rates will drop significantly if RuPay cards are accepted in more global PoS,” says Ankush Setia, co-founder of credit card comparison platform Multiply.

Soon after the RBI’s circular, travel and forex services major Thomas Cook partnered with the NPCI to launch a RuPay prepaid forex card for Indians travelling to the UAE. (The product will be expanded to other territories after the pilot.) Besides acceptability in online and offline PoS, the card offers compelling benefits, from lounge access and Thomas Cook vouchers to free ATM withdrawals and accidental insurance cover worth Rs 7,50,000. It’s a win-win for both consumers and forex issuers, given outbound travel from India is witnessing unprecedented growth.

NPCI, meanwhile, believes that the RuPay Forex card is poised to be a “game-changing product” for consumers. “As travel demand returns to normal, Indian tourists will soon have access to a myriad of enticing benefits and rewards offered by this card. Our goal with the RuPay Forex card is to create an unparalleled end-to-end consumer experience for Indian travellers,” it said in a statement.

Besides the forex cards, there’s also the RuPay Global card which is already being accepted at 42.4 million PoS terminals and 1.9 million ATMs in 200+ countries, according to the NPCI website. In addition to this, the NPCI has also partnered with local banks in Bhutan, Nepal, Singapore, and the UAE to launch RuPay cards and domestic card systems in those countries.

It is increasingly evident that RuPay will not remain just an Indian phenomenon. The government wants to establish it as a strong alternative to other global card networks. “It is an incredible opportunity if RuPay goes global like VISA or Mastercard,” says Shetty of BankBazaar. “Because remittances to India are fairly large ($100 billion annually), and cross-border remittances aren’t inexpensive transfers. If RuPay can help Indians remit money faster and cheaper, it would be an incredible benefit to the diaspora,” he explains.

Infographic: Ahamed Thahir

With all the activity and buzz around RuPay, it begs the question: Are consumers fully cognisant of all that it offers?

Setia, whose Multiply platform recommends the right set of credit cards to customers based on their spending patterns and income levels, tells The CapTable, “Consumers want at least one RuPay card where they can shift their UPI spends (even the small-value purchases) and that offers them the best rewards. Debit cards, on the other hand, are seeing a slow death, and those spends have now moved to the UPI credit card.”

The Tata Neu HDFC RuPay credit card, for instance, has been a runaway success in this regard. Over half a million of these cards have already been issued, and customers earn 1.5% NeuCoins (1 NC=1 rupee) on their UPI spends, be it online purchases or utility bill payments.

Several other cards are also readying the launch of their RuPay variants given how “enamoured” Indians have been about linking UPI with credit cards. “We hear that the Amazon Pay-ICICI card will also be offered on RuPay in the coming months,” a person close to the development told The CapTable. Currently available on VISA, it is one of India’s most successful credit cards, accounting for almost 30-35% of ICICI Bank’s entire portfolio of credit cards. And more often than not, it has also been a first-time user’s initiation into the world of credit cards. “With the rising competition, it is possible that the Tata Neu-HDFC card may not remain the most preferred RuPay card. Some other lifetime-free card might just take over,” adds the person.

Besides traditional banks, the other entities boarding the UPI-RuPay train are fintechs like Paytm, Slice, Jupiter, Kiwi, and more. “Startups, which are issuing RuPay cards for their core target segment, are seeing good use cases and much higher usage volumes than the PSU-issued RuPay cards,” shares Anshul Gupta, chief investment officer & co-founder of Wint Wealth (a bonds and fixed deposits platform). “The PSU issuance rate is high because they are being pushed by the government to promote RuPay, but the card usage is low. For fintechs, the issuances are lower, but usage is much higher,” he says.

Earlier this year, Kiwi partnered with Axis Bank to launch a virtual UPI-linked RuPay card that offers customers 1% cashback on ‘Scan & Pay’ transactions, fuel surcharge waivers, and other rewards. Kiwi wants to reach 1 million users with its RuPay credit cards in 18 months. Axis Bank also launched a numberless RuPay card in partnership with fintech platform Fibe, which comes with attractive rewards and cashbacks too.

Prior to this, Paytm was one of the first fintechs to launch a RuPay co-branded card with SBI. At the launch, CEO Vijay Shekhar Sharma announced that “India is at the cusp of the next payments revolution where credit will become the mainstream payment choice.” Like other RuPay cards, this too comes with exclusive offers and benefits (worth up to Rs 75,000), including a complimentary Paytm First Membership, OTT subscriptions, cashbacks on movie and flight tickets on the Paytm app, etc.

More recently, ahead of the festive season sale, Amazon India enabled EMI payments on RuPay cards, thus giving buyers more options to maximise their purchases. Other online merchants like BookMyShow frequently partners with event organisers to offer exclusive cashbacks and rewards to RuPay users. One such upcoming event is Nykaaland 2023 (Nykaa’s annual beauty festival in Mumbai), where users stand to receive cashbacks worth Rs 10,000 if they buy tickets with RuPay cards.

“There is a monopoly being created for RuPay. People will continue to be incentivised to use UPI on credit cards, and that could eventually cannibalise the market (i.e. bring down direct UPI spends),” warns Gupta of Wint Wealth.

However, that may not be RuPay’s only problem yet.

While it is largely positive on the consumer front, there’s been an upheaval brewing within the merchant community over the interchange fees they have to pay in order to accept UPI-linked credit card payments. At present, there are no charges levied for transactions lower than Rs 2,000. But large merchants, who have average ticket sizes higher than that, aren’t exempted from the merchant discount rate (MDR).

In the case of UPI-linked RuPay cards, the MDR is even higher than regular credit card charges and includes additional UPI-related charges too. As a result, many merchants have begun disabling UPI payments via credit cards at their end.

“Because the charge is higher than normal, some merchants might not want to absorb that kind of interchange fee. But merchants are smart enough to decide what’s best for them,” says BankBazaar’s Shetty. “It’s too early to offer guidance on whether the stakeholders will arrive at a lower fee or not.”

HDFC Bank reveals that it has seen little resistance from merchants so far. “We have not seen too many issues or complaints about interchange fees. Many small merchants don’t accept cards and that existed even before UPI happened,” Rao clarifies. “However, the ask from the industry is that there should be some element of economics built into the UPI model so the stakeholders can make continued investments into payment technologies, security, innovation, and so on,” he adds.

Banks currently don’t earn anything from direct UPI payments, and hence, it is their constant endeavour to move customers to other credit products, which is also one of the factors driving RuPay credit card usage. But the resistance around MDR cannot be escaped, according to Gupta of Wint Wealth. “Merchants usually have wafer-thin margins. So there will be resistance,” he says, “But in categories where margins are higher, they might even agree to accept UPI-RuPay payments but only if there’s a value proposition that banks can establish for them.”

With India’s credit card spending touching new highs every month, the expectation is that all stakeholders—government, NPCI, RBI, card issuing banks, payment gateways, merchants, and consumers—will align on a structure that will not only enable financial inclusion but also fuel India’s dream of becoming a truly cashless economy.

After all, that’s why RuPay came about in the first place!

Edited by Ranjan Crasta

Got a tip? If you have a lead we should be chasing at The CapTable, write to us at tips@the-captable.com

Convinced that The Captable stories and insights

will give you the edge?

Convinced that The Captable stories

and insights will give you the edge?

Subscribe Now

Sign Up Now